The Macro Mood

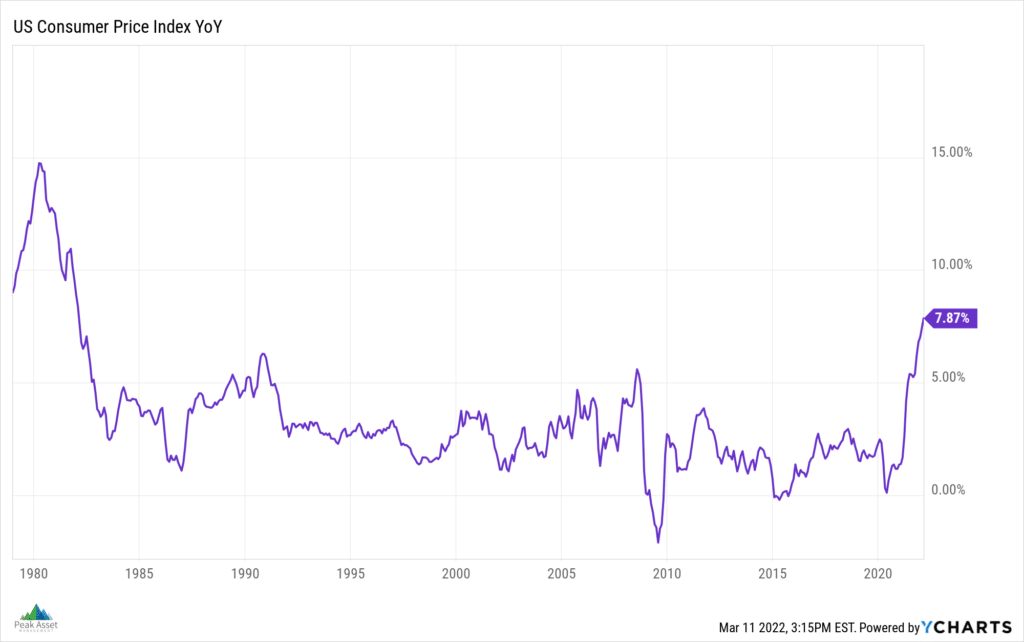

Even before Russia invaded Ukraine, inflation (as measured by the Consumer Price Index) was touching levels not seen in the U.S. since the early 1980s. While most people have and will continue to be hit by rising prices, at the start of the year I was anticipating that decelerating economic growth, easing supply chain constraints, and a more stable labor market (as the Omicron variant receded) would help contain inflation through 2022.

The tragic outbreak of war in Ukraine has complicated the outlook for inflation. Russia and Ukraine supply tremendous quantities of commodities to the world. Whether it’s hydrocarbons, wheat, or rare earth metals, shock waves are rippling through markets as buyers and sellers sort through the implications of war and economic sanctions. The consequences have and will continue to reach far beyond the immediate brutality of the fighting on the ground in Ukraine. Only time will tell how markets, businesses, and consumers will navigate these supply shocks and wild price swings in the basic building blocks and material inputs to the global economy.

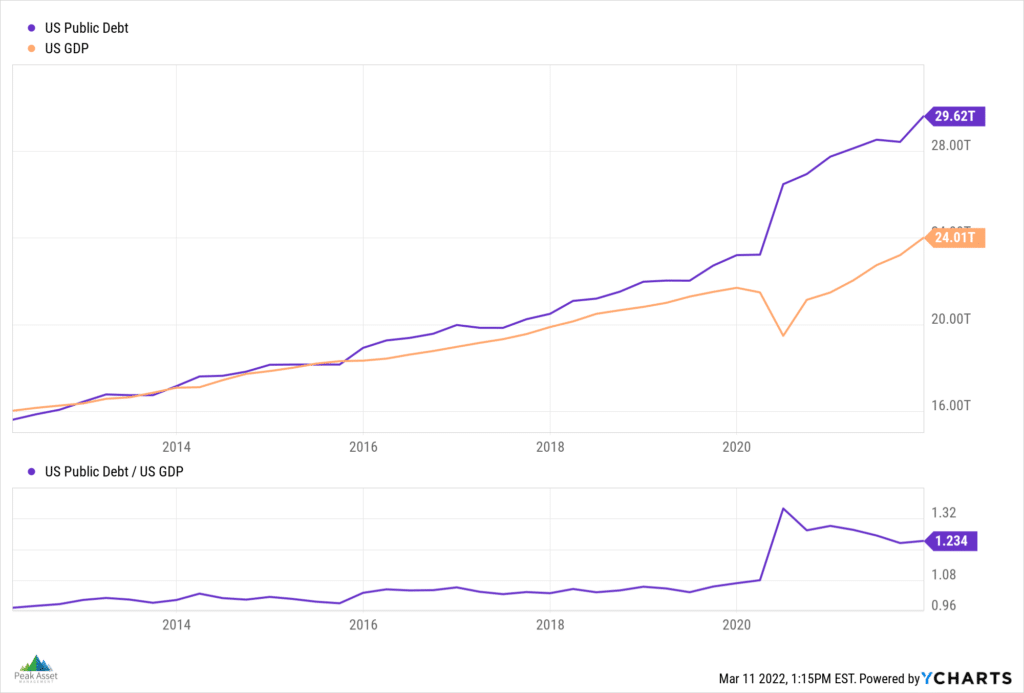

As if we didn’t already have enough macroeconomic news to digest, the long-term outlook for real GDP growth in developed economies is (perhaps) more concerning than the here-and-now of inflation. In fact, my hunch going into 2022 was that elevated levels of debt (relative to GDP) and aging demographics would actually serve as brakes on price inflation over the next 12-18 months.

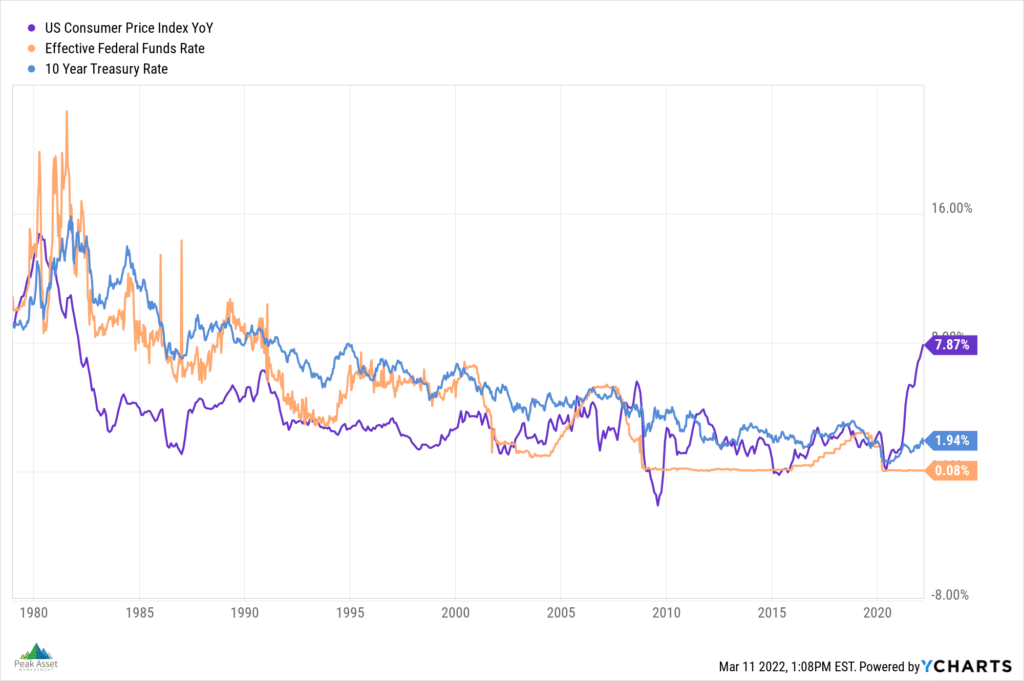

To understand these dynamics, I’ve found the work of Dr. Lacy Hunt at Hoisington Investment Management to be particularly helpful. Dr. Hunt’s view is that interest rates (and, despite the recent surge, inflation) have been and will continue to remain in a long-term downtrend.

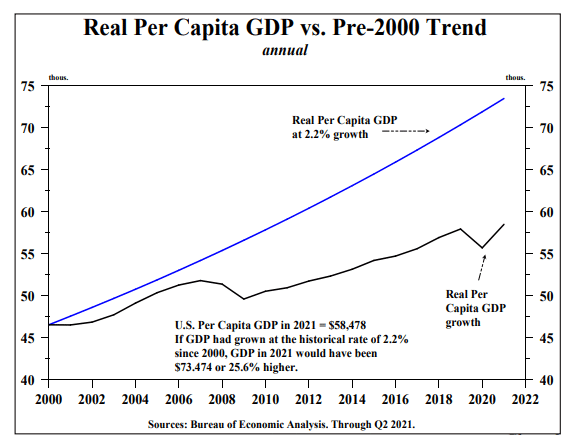

The empirical literature suggests that overindebted economies with aging populations become trapped in slow growth and low interest rate environments that, for better or worse, are disinflationary. Highly indebted economies have trouble growing real GDP per capita and the global debt to GDP ratio for 2020-2021 “is almost certainly the highest on record for any two-year period.” We can see this dynamic playing out over the past two decades in lackluster real GDP per capita growth relative to average historical growth rates of 2.2% annually in the U.S. prior to 2000.

Source: Hoisington Investment Management.

In his latest economic review (prior to the outbreak of war in Europe), Dr. Hunt noted:

“With money growth likely to slow even more sharply in response to tapering by the FOMC [The Federal Reserve], the velocity of money in a major downward trend, coupled with increased global over-indebtedness, poor demographics and other headwinds at work, the faster observed inflation of last year should unwind noticeably in 2022.”

COVID instigated two massive shocks to the economy. First, a simultaneous shutdown of nearly all supply and demand. Second, and subsequently, a massive boost in consumer demand thanks to trillions and trillions of dollars of government stimulus (financed by public debt).

While some of the immediate interventions may have staved off a deflationary depression, the government response to COVID was narrowly focused on boosting demand, not supply. Consumers flush with cash have been bidding up the price of goods and services from businesses that are still struggling to get production and staffing back online.

The impacts of the COVID stimulus will eventually fade just like the crash that follows a sumptuous, dessert-induced sugar high. Coupled with the structural backdrop of stagnant real GDP per capita formation and aging demographics around the world, my base case assumption is that a rerun of 1970’s-style inflation is unlikely to repeat in the coming years. To be sure, there are very real “risks” to this hypothesis that complicate the outlook for inflation: The Russian invasion of Ukraine, as wars tend to be inflationary; underinvestment in commodities and material industries in recent years; and ongoing labor shortages and wage-price inflation. That said, the long-term structural issues have not disappeared and may serve as a drag on inflationary pressures.

All of this is interesting to ponder, but what to do as an investor? At the top of the year, we had noted in a blog that markets were precariously perched when compared to historical valuation levels. We observed that after a relatively calm 2021, an uptick in volatility was to be expected in markets. In fact, the -10% correction in the S&P 500 so far in 2022 is consistent with a long-term average of -14% intra-year drawdowns on the index. Where the market goes from here is still anyone’s guess, but the point of studying history is to keep an open mind and recognize that a wide range of potential outcomes, whether positive or negative, are a normal part of the game.

Our comment for investors in that blog was “to be cautious, moderate their expectations for future returns, trim their winners, and rebalance back to target equity allocations that are consistent with their ability (and willingness) to take risk.” Despite the war and tragedy unfolding in Europe, it is safe to say that the long-term strategy for navigating market cycles has not changed.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.