We recently had the pleasure of reading The Psychology of Money by Morgan Housel. The book is a thoughtful examination of our relationship to money and investing. Housel guides the reader through a complex subject by sticking to simple narratives and timeless principles. The book has since become a go-to recommendation to our clients. Below we highlight some of our favorite insights.

Tale As Old As Time

Time is a – or perhaps the – key ingredient to successfully save, invest, and achieve financial security. Time is the secret engine behind compounding, and compounding is an exponential phenomenon that our brains are not well suited to understand.

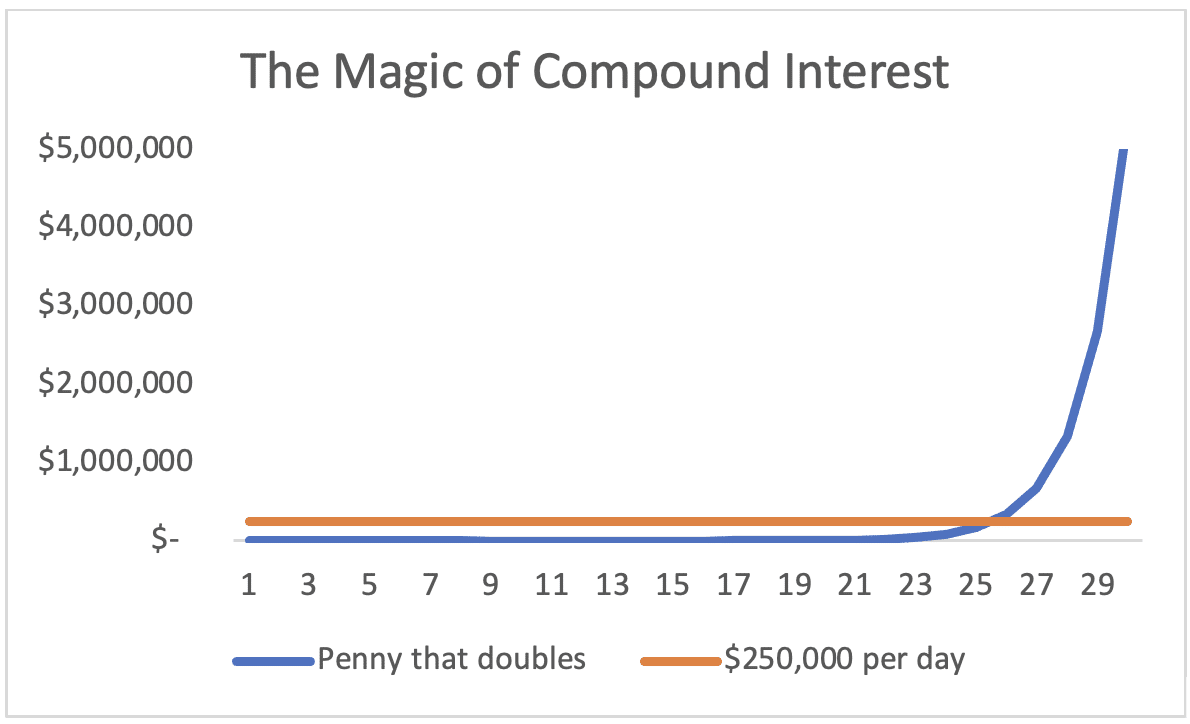

If you were asked to choose between receiving $250,000 per day for the next 30 days, or a penny today that doubles every day in value for the next 30 days, which would you choose? Whether or not it is intuitive to you, the answer is to take the penny that doubles every day for 30 days:

The key to compounding is to not disrupt the magic, hence the importance of time. If the above example were only in effect for 29 days (all else being equal), $250,000 per day would result in a larger cumulative gain. Housel writes:

“[Good] investing isn’t necessarily about earning the highest returns, because the highest returns tend to be one-off hits that can’t be repeated. It’s about earning pretty good returns that you can stick with and which can be repeated for the longest period of time. That’s when compounding runs wild.”

Allowing time and compounding to work is a simple concept that’s hard to practice. It takes tremendous emotional intelligence and discipline – not financial or investing acumen – to stay the course. That takes us to another key concept from The Psychology of Money: You have to know who you are and what your goals are in order to stay in the game long enough for time and compounding to work their magic.

Finding Freedom

It is easy to be distracted by what other people say you can or should do with your time and money. Whether it’s a blurb on social media, a talking head on TV, or a conversation over the fence with your neighbor, there is a cacophony of investment advice, tips, and tricks competing for our attention. At best these are distractions. At worst, the distractions make it impossible to truly understand yourself and implement an investment strategy to achieve your goals.

Housel helps the reader parse through the noise by emphasizing the importance of freedom and control over your time as the primary goal for implementing an investment plan:

“More than your salary. More than the size of your house. More than the prestige of your job. Control over doing what you want, when you want to, with the people you want too, is the broadest lifestyle variable that makes people happy.”

Investing is not a competition. It is not a race to see who can accumulate the most money in the shortest amount of time to buy the most stuff. Many people try to play that game, but more often than not it ends in disaster. By framing your investment goals within the context of freedom and control, however, it is much easier to ignore the distractions that would otherwise interrupt investment returns compounding through time.

A Good Night Sleep

It is often said that to be a successful investor requires objectivity. The abundance of market data and the accessibility of financial products seems to reinforce the idea that investment strategies ought to be developed and implemented with cold and rational calculation. But the S&P 500 does not have a mortgage. The Nasdaq 100 does not have a kid to put through college. As humans, we have hopes, dreams, and the need for a good night’s sleep. Housel writes that when it comes to money and investing, you should strive to be reasonable rather than rational:

“Academic finance is devoted to finding the mathematically optimal investment strategies. My own theory is that, in the real world, people do not want the mathematically optimal strategy. They want the strategy that maximizes for how well they sleep at night.”

Just because spreadsheet math dictates that a certain course of action may generate the highest returns, the emotional stress and risk required to implement that plan may not be worth it for the average investor.

To borrow a page from our own book at Peak, we believe it is “reasonable” to buy and own individual stocks. A lot of ink has been spilled arguing that the “rational” approach (based on the efficient market hypothesis) is to own the entire market through passive funds or ETFs. But when times are tough, we find that it is far more comforting to own real businesses. You can look at your portfolio and say: “It doesn’t matter what the market is doing today. I still believe in these companies.” We sleep much better at night owning great businesses.

These are just some of the key ingredients that Morgan Housel explores throughout The Psychology of Money. Thankfully, achieving financial security does not require complex strategies or secret financial sauce. It is our own behavior and the way we establish goals and expectations that give us the best shot at a healthy and productive relationship to money and investing.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.