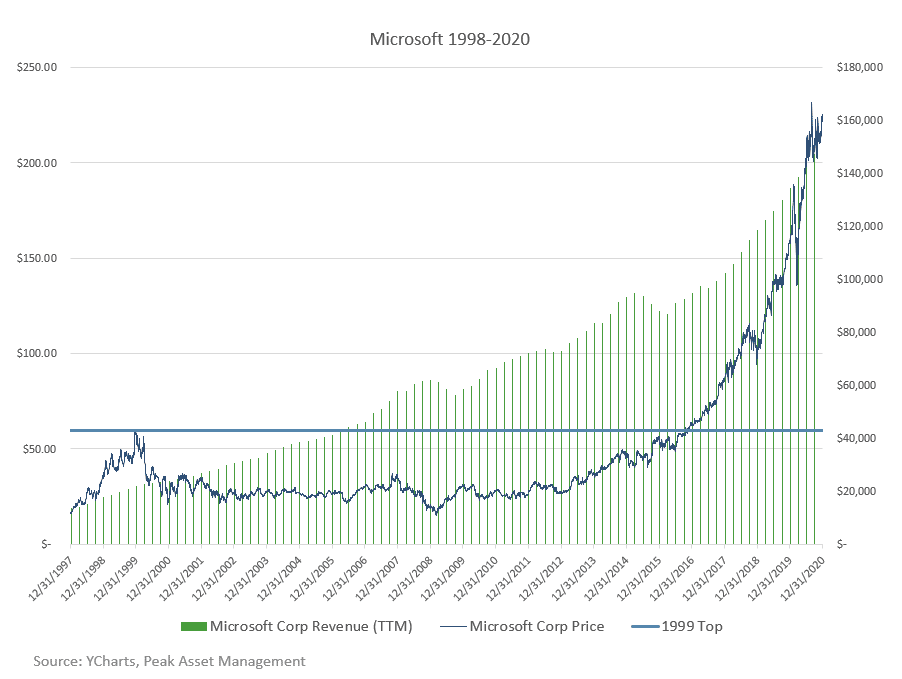

On December 27, 1999, Microsoft closed the day at $59.56 per share (split-adjusted). When the dot-com bubble burst in the ensuing months, it ultimately took 17 years (until October of 2016) for Microsoft’s stock price to regain the high from 1999.

At that fateful peak in 1999, shares in the enterprise software behemoth traded hands at 31x sales (and Microsoft’s valuation was by no means the most egregious relative to other publicly traded issues at the time). To conceptualize what paying 31x sales means, think of it like this: “You can buy this company and it will continue to generate the same amount of revenue every year in perpetuity. Not only that, the company has no costs and generates a 100% profit margin, every year. In 31 years, you’ll get your money back with a 0% holding period return on your investment”.

Of course, paying a princely price/sales multiple presumes that topline revenue growth will skyrocket for years to come. In fact, Microsoft did go on to generate incredibly strong growth over the next two decades, but investors who bought shares around the high in 1999 may not have noticed.

At the turn of the millennium, Microsoft had racked up $21.86 billion in sales over the preceding 12 months. Fast forward to the end of 2021, and that figure has blossomed to $184.9 billion, an impressive ~10.2% compound annual sales growth rate over 22 years.

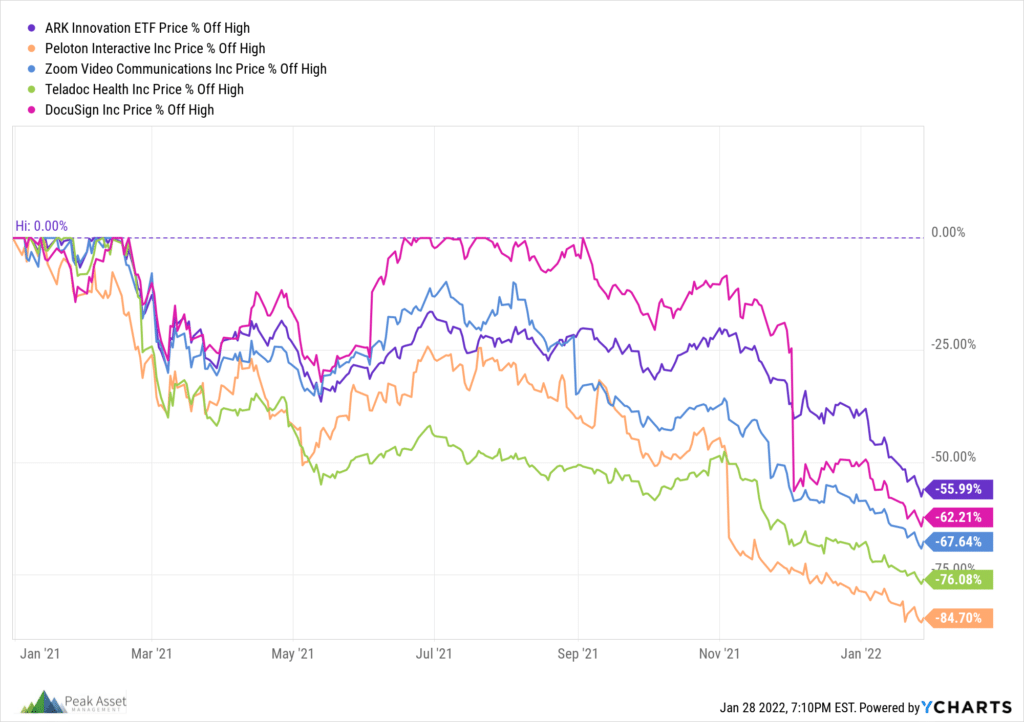

Many high-growth tech companies may be experiencing a similar fate today. In January of 2021, we wrote about the exorbitant enthusiasm that investors had for the family of ARK Invest ETFs. Shortly thereafter, their flagship fund (ARKK) hit a 52-week high on February 12, 2021. Since then, it is down 56% (as of the time of this writing on January 28, 2022).

Other stocks that defied gravity and fetched lofty price/sales multiples in 2020 as the stock market rallied through the pandemic have experienced similar (if not more agonizing) drawdowns. Peloton, Zoom, Teladoc, and DocuSign – some of the names that captivated investors’ imaginations thanks to the “work from home trade” – are in free fall.

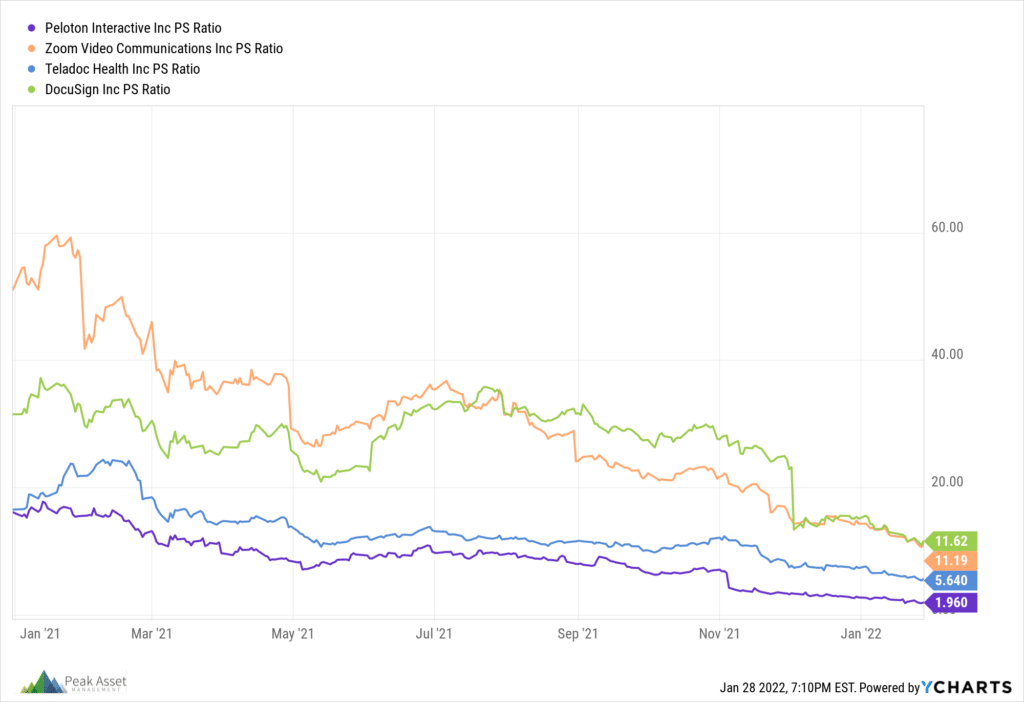

At their highs, these companies traded for incredibly rich price/sales multiples. Zoom, a fantastic business that we have no doubt will continue to grow and shape our lives for years to come, was trading for 60x sales in January of 2021. For comparison, the price/sales multiple on the S&P 500 as of January 28, 2022 is 2.79x (Source: Yardeni Research, Inc.). Not to mention, 2.79x sales is an historically elevated multiple for the broader index itself.

While it should go without saying, all of these examples are striking reminders that the price you pay for an asset is a consequential component of the investment decision. Even if it’s a great business that continues to grow revenues up and to the right for years to come, the stock itself can move in the other direction, often times longer than an investor may be willing to hold it.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.