Stock Review: Fortinet (FTNT)

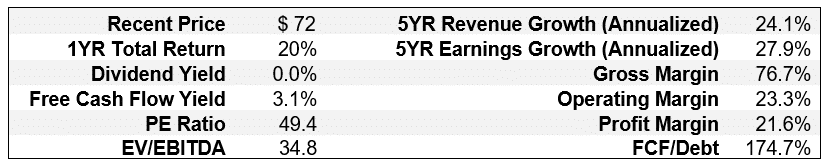

We recently added Fortinet (FTNT) to our model stock portfolio*. FTNT is a leading cybersecurity company based in the U.S. with over 700,000 customers worldwide. In 2023, they generated $1.7 billion of free cash flow on revenues of $5.3 billion. FTNT is characteristic of the businesses that we like to own: They have an incredible balance sheet with no net-debt; strong cash flow margins (>20% operating profit margins and >30% free cash flow margins), a strong management team led by the company’s founders, and secular growth tailwinds in their industry.

Hybrid workforces and cloud computing have made it harder for both large and small enterprises to defend against cybersecurity threats. We like Fortinet’s position as a leading platform for the full stack of cybersecurity solutions, both on the hardware side with traditional firewalls and the software side to help businesses detect, prevent, and respond to cyber threats in real time.

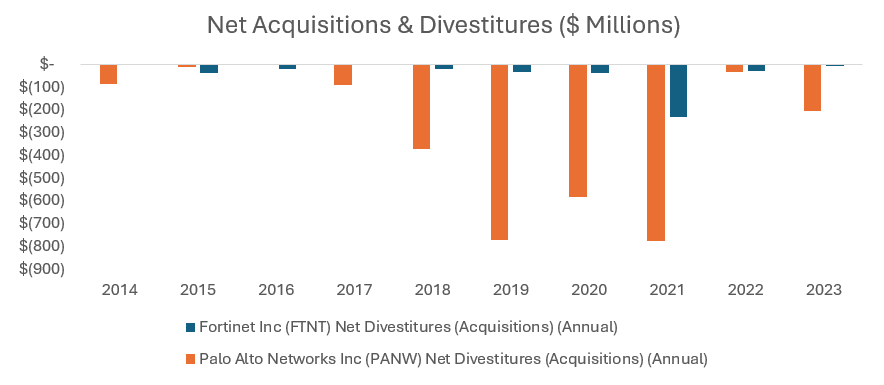

We also like Fortinet’s “build vs. buy” model of organic growth through investments in R&D, technological leadership, and patent development. One top competitor, Palo Alto Networks (PANW), generates more revenue on a trailing-twelve-month basis ($7.5 billion compared to FTNT’s $5.3 billion), but they have achieved a lot of that growth inorganically by acquiring other companies. In total, PANW has plowed $2.9 billion into acquisitions since 2014:

In early 2022, Fortinet’s price to free cash flow reach 48x, a lofty valuation just as the last firewall refresh cycle was peaking. Since then, the stock has traded sideways and remained essentially flat over the last two years. On their last earnings call, Keith Jensen, the CFO, provided some perspective on the cyclicality in their firewall business:

“As we look to 2024, several factors impact guidance, including the firewall industry cycle, remnants of 2022 and 2023 supply chain activity, and customer buying behavior. Prior firewall product life cycles have lasted approximately four years, with eight quarters of higher growth followed by eight quarters of slower growth. Looking at our bookings, the current product cycle decline started approximately four quarters ago in Q1 of 2023, suggesting that we should experience the bottom of the cycle in early 2024.”

As the firewall refresh cycle troughs and as Fortinet continues to rollout new software solutions as part of the FortiOS cybersecurity platform, we believe they can grow revenues in the mid- to high-teens over the next five years and achieve high single-digit revenue growth thereafter (revenues expanded 24% per year over the last five years). From this perspective, Fortinet is a classic example of a quality growth company that we believe is trading at a reasonable price.

As always, any one individual stock can be a volatile investment. Our goal with Fortinet, alongside the other stocks in our model, is to own a portfolio of great businesses that have strong cash flow generation, a dominant brand or industry position, and a management team that can navigate the inevitable ups and downs of the economic cycle.

*The Model Portfolio is not a real cash portfolio. It represents the core direction of our portfolio management strategies. Individual client portfolios are managed in accordance with the clients’ specific investment objectives and constraints.

Advisory Services offered through Peak Asset Management, LLC, an SEC registered investment advisor. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This content is developed from sources believed to be providing accurate information and may have been developed and produced by a third party to provide information on a topic that may be of interest. This third party is not affiliated with Peak Asset Management. It is not our intention to state or imply in any manner that past results are an indication of future performance. Copyright © 2024 Peak Asset Management

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.