Rolling with the Punches

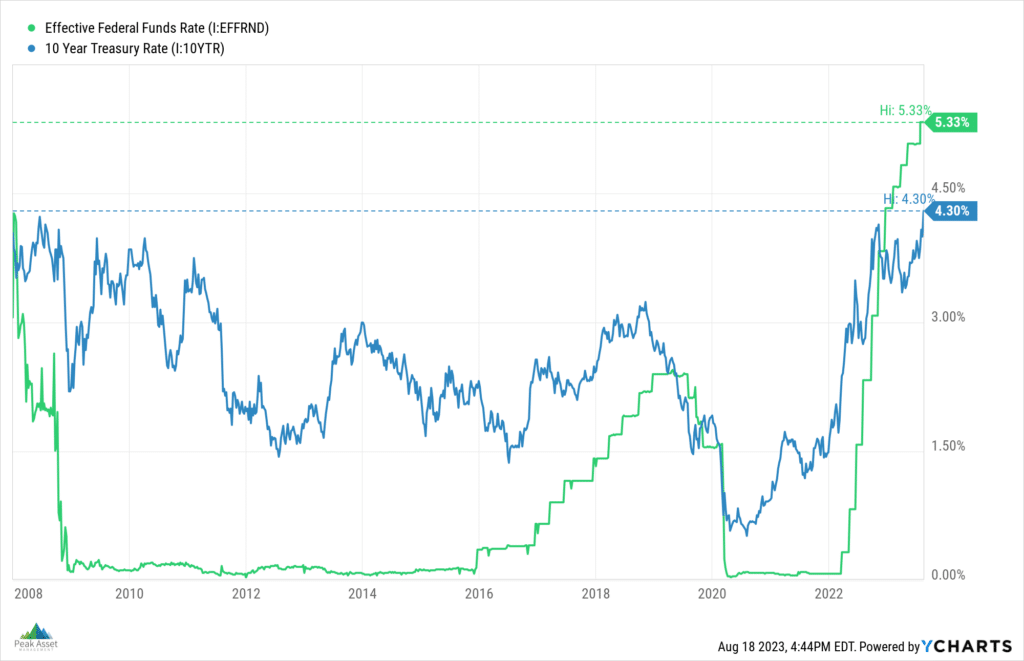

The Federal Reserve has raised the effective Fed Funds rate over the past 18 months from 0% to 5.33%. The 10-year US Treasury Yield just hit a 15-year high around 4.30%. Mortgage rates are back above 7%.

Source: YCharts via Peak Asset Management

If we had known that this is where benchmark borrowing costs were headed at the start of 2022, it would have been reasonable to assume that by August 2023, financial conditions would be tight and that corporations (and households) would be feeling the pain of higher rates.

Fast forward to today and higher interest rates have barely had an impact on US corporations. The Silicon Valley Bank debacle did stem from poor interest rate risk management, but that was a classic bank run and not a credit event.

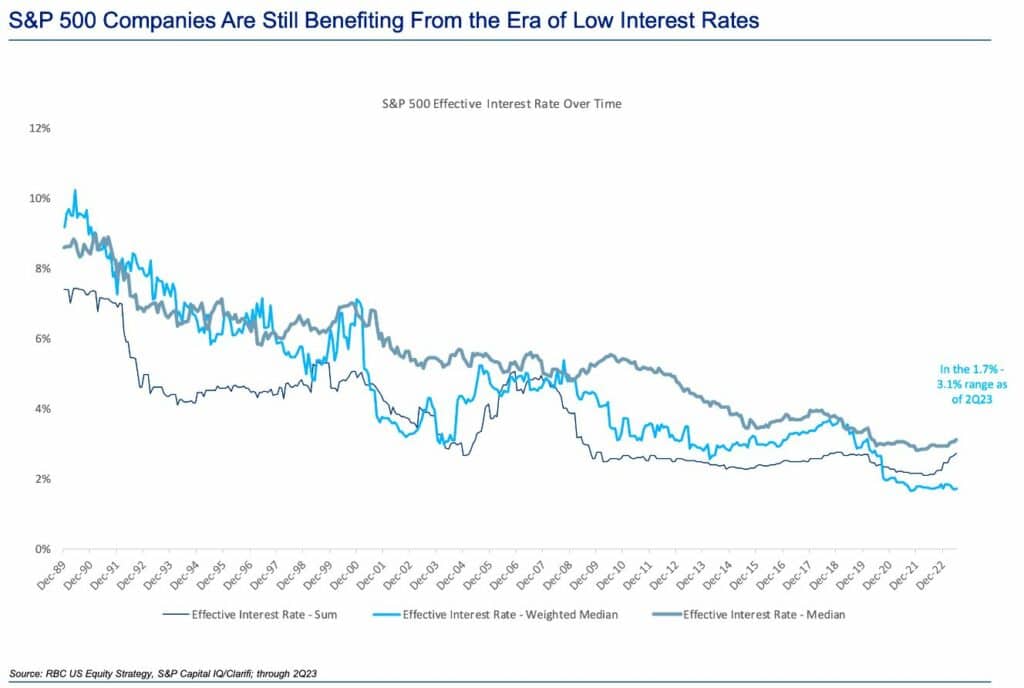

Businesses are still going strong. Management teams borrowed a lot of long-term, fixed-rate debt at low rates over the past few years and may be able to stomach higher rates for some time. The following chart from RBC shows just how low corporate borrowing costs are today compared to history:

Source: RBC US Equity Strategy via TKer.co

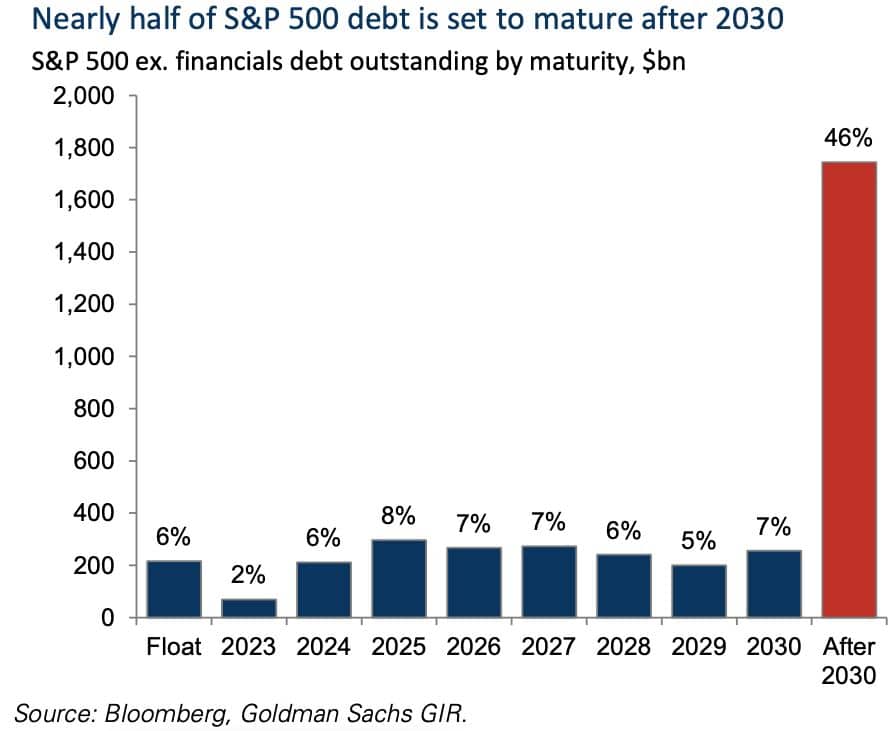

And the following chart from Goldman Sachs shows that 46% of that debt won’t mature until after 2030:

Source: Goldman Sachs via TKer.co

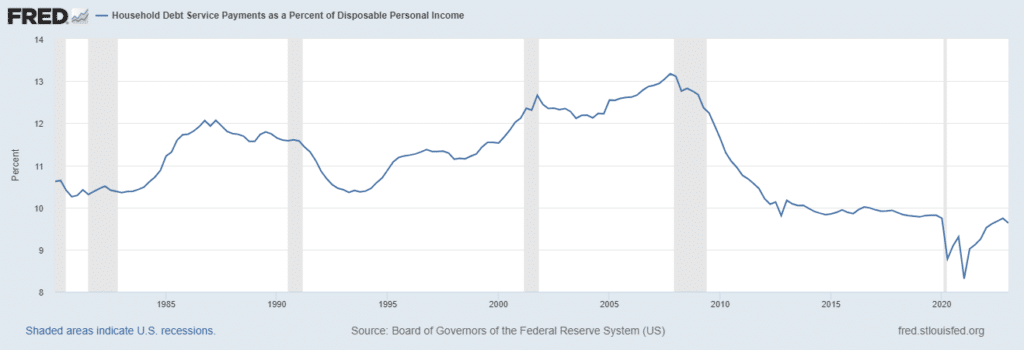

In a similar vein, household debt service payments as a percent of disposable income remain around historic lows:

Source: FRED

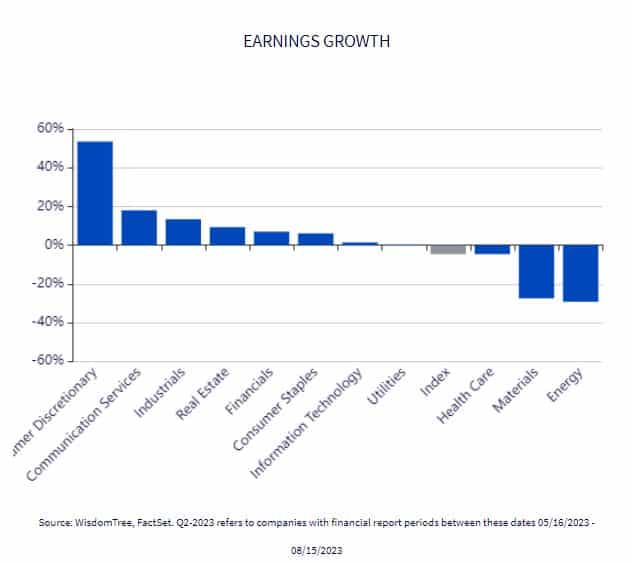

Corporate and household balance sheets appear to be in decent shape despite the dramatic uptick in benchmark borrowing costs. US economic growth has been robust this year, and for the first time in a long time it appears that average wage gains in the US are outpacing inflation. S&P 500 companies turned in a decent second quarter, with Health Care, Materials, and Energy being the only sectors to post a year-over-year decline in earnings:

Source: WisdomTree PATH

All of these conditions are subject to change and there are plenty of risks to the notion that “balance sheets are fine”:

- The Federal Reserve may be compelled to keep raising interest rates in the face of accelerating economic growth and/or inflation;

- Higher interest rates could continue to put stress on banks that have to contend with depositors pulling out cash faster than the banks can right-size their asset portfolios;

- Stress in the commercial real estate market (think vacant office buildings) could put real pressure on regional banks and other lenders (with spillover effects to the rest of the economy);

- Consumers may be compelled to take on more leverage to buy a home or use credit card debt to keep up with inflation, and credit card delinquencies have accelerated in recent months;

- Corporations will eventually have to refinance debt maturities at higher rates, forcing more companies into bankruptcy and pressuring margins; and

- The real estate bubble is bursting in China, which could spill over into the rest of the global economy.

Despite the obvious storm clouds in financial markets, both corporations and households in the US have been resilient in the face of rising interest rates. For now, that is great news.

Peak Asset Management, LLC is an SEC registered investment adviser. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This content is developed from sources believed to be providing accurate information and may have been developed and produced by a third party to provide information on a topic that may be of interest. This third party is not affiliated with Peak Asset Management. It is not our intention to state or imply in any manner that past results are an indication of future performance. Copyright © 2023 Peak Asset Management

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.