We have to get supply and demand back into alignment and the way we do that is by slowing the economy.

Federal Reserve Chair Jerome Powell 09/21/22 Press Conference

The Stock Market and Speculation Deflation

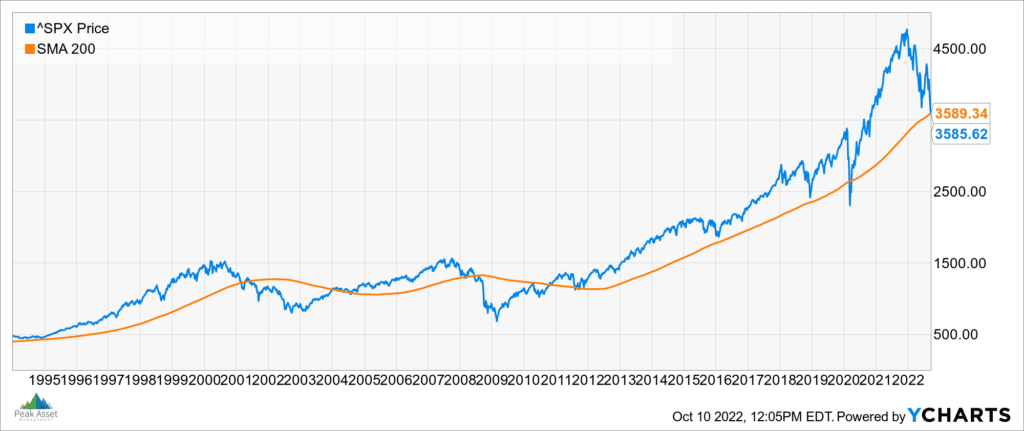

The stock market closed the 3rd quarter at the low for the year. As measured by the S&P 500 (with dividends), stocks closed down (-4.88%) for the quarter and down (-23.87%) on the year. The decline in stocks has taken the S&P 500 back down to the level it first reached in November 2020. As pictured in the chart below (1995 – Sept 2022), it also took the stock market back to its 200-week moving average, a level I have come to appreciate as a kind of emotional neutral zone between the extremes of the speculative bull spikes and the Armageddon inspired bear plunges. Coming off the December high in stocks, it is certainly not fun for investors to get back down to the neutral zone. Now that we’re here, however, the risk vs. return tradeoffs for long-term investors are much more attractive.

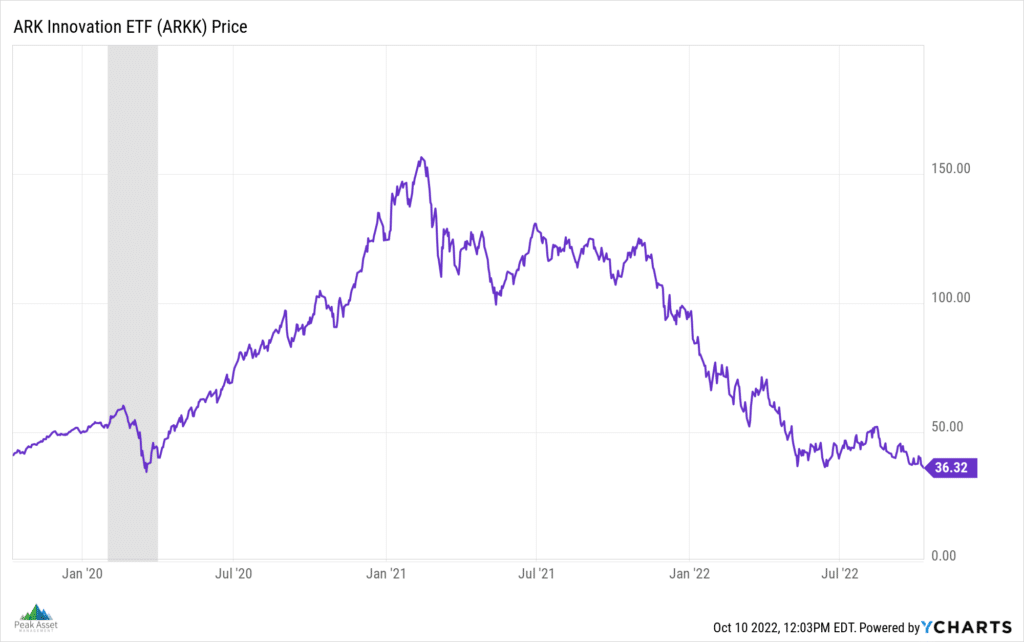

To illustrate the dramatic cooling of speculative excesses in stocks, the next chart follows the rise and fall of the ARK Innovation Fund. The approach of the fund is focused on building a portfolio of businesses with immense earnings potential far into the future combined with an unabashed willingness to pay large multiples of current sales now for those potential future earnings; i.e., an all-out aggressive growth approach. Starting from its price at the COVID closing low in March 2020 of $34.69, the fund has made a stunning round trip, climbing 440% to its 2021 February high of $153, and then falling back to a $37 level in September. The top ten high-flying stocks owned by the fund at its all-time high included: Tesla, Teledoc, Coinbase, Roku, Unity Software, Zoom Video, Spotify, Square, Shopify and Twillio.

The Bond Market, Interest Rates and Silver Linings

Similar to stocks, the bond market closed the 3rd quarter near its low for the year. As measured by the iShares Core U.S. Aggregate Bond ETF, the total return for bonds in the quarter was down (-4.7%) and for the year was down (-14.38%). Those are tough numbers for bond investors, and if they finish the year at this level, it would be the worst year for bonds in the 45 years that the aggregate bond index has been tracked. While individual bonds, if held to maturity, will return investors’ principal investment to them in time, the current price volatility is real and even a temporary loss in the “conservative” portion of an investor’s portfolio is particularly impactful in a year when stocks are down as well.

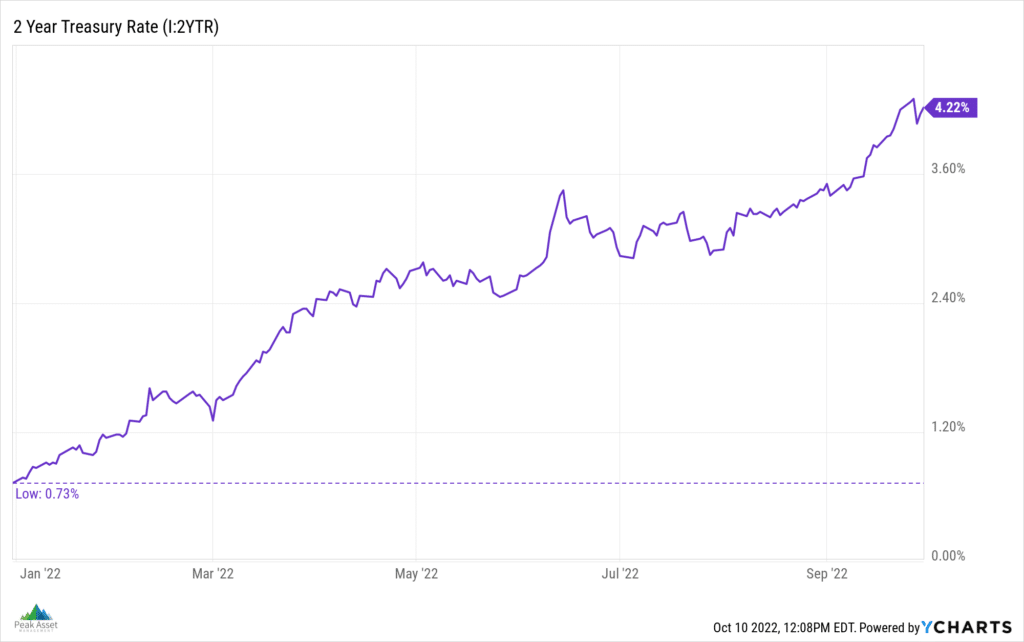

To illustrate the dramatic rise in interest rates, the chart below tracks the rate on the two-year Treasury note from the beginning of the year. The yield has risen from .73% at the end of 2021 to 4.22% on 09/30/2022. That is a 578% increase in 9 months. Because higher interest rates offset more of any future downside price volatility, the interest rate increase that has already occurred this year has materially reduced future risk in the bond market. Importantly, the higher yields across various types of bonds and various maturities of bonds have greatly enlarged the investment opportunity set outside of stocks for conservative assets. As a portfolio manager and an investor, the difference between today’s interest rate environment and the zero percent framework of just one year ago is magnificently delightful!

Meet the New Federal Reserve

The Fed has embraced its role as the inflation fighter. In his latest press conference on September 21st, Fed Chair Jerome Powell clearly communicated that the Fed is committed to getting inflation back down to its 2% target. He acknowledged that the blunt tools the Fed uses to reduce demand in the economy will cause pain. He clearly stated that the Fed would err on the side of keeping its monetary policies tighter for longer to make sure it has met its inflation reduction goal, because if it doesn’t get it under control now the pain in the future will be even greater. For now, I will take the Fed at its word. The real test of its inflation fighting commitment will be how it reacts to any unexpected financial cracks that its restrictive policies either expose or create. If it reacts with restraint, I think the Fed can, per the quote that opened this letter, reach its goal of getting “supply and demand back in alignment.” It’s just going to take some time.

* * * * * * *

We hope this letter finds you and your family well. We appreciate your business and we continue to work hard to earn the trust that you have placed in us. Please let us know if you have a friend or a family member who could use our assistance.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.