Not-So-Boring Bonds

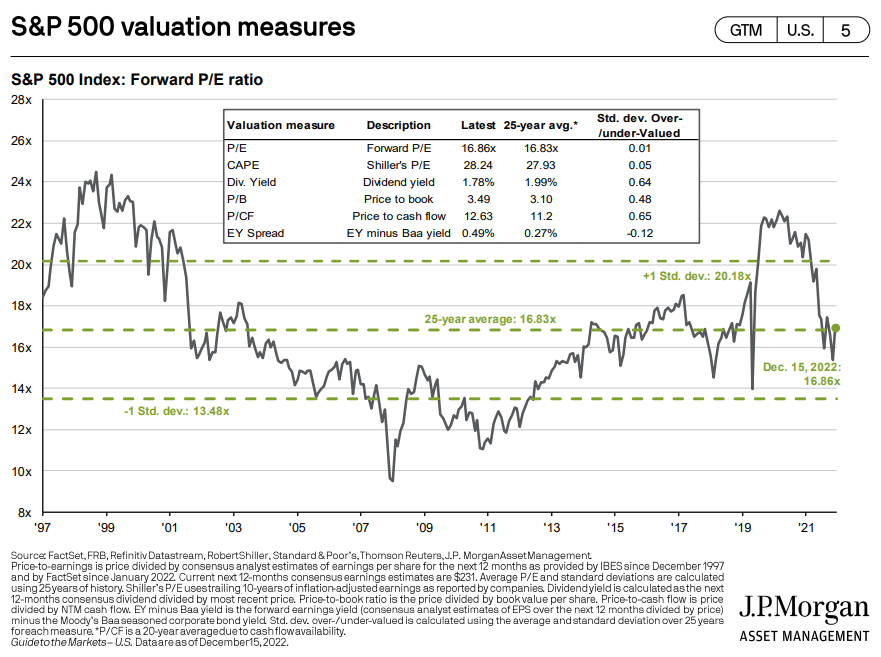

At the top of 2022, we wrote that stock market multiples were precariously perched after soaring well above historical averages. Since then, multiples have pulled back to more benign averages:

Source: J.P. Morgan Asset Management, Guide to the Markets, 12/15/2022

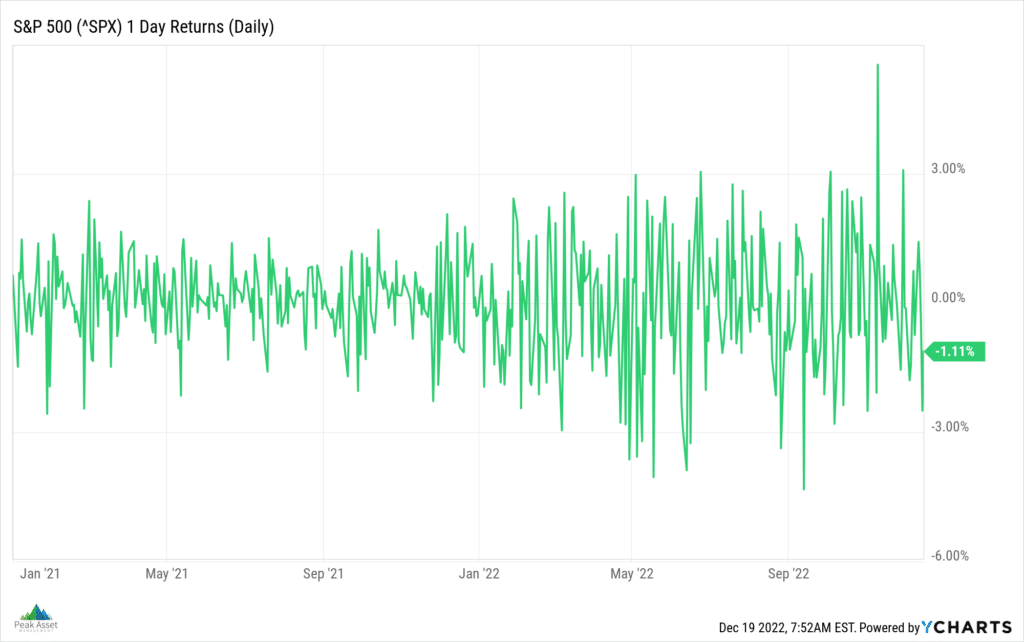

We had also noted that after a relatively calm year in the S&P 500 in 2021, it would not be surprising to see volatility pick up in 2022. A two-year lookback at daily S&P 500 returns in the chart below illustrates how equity price swings have been a bit more hectic in 2022 versus 2021:

But the real story in 2022 has not been equity multiple contractions or stock market volatility. Drawdowns in the stock market are par for the course. Even when the S&P 500 was at its intra-year low at the end of the third quarter, we had noted in our Client Letter that stocks had pulled back to a rather boring (not-too-hot, not-too-cold) level around the 200-week moving average.

The real story in 2022, rather, has been a not-so-boring bond market. In an inflationary environment with rising interest rates, “fixed” income investments lose their luster and prices for bonds have come under considerable pressure this year.

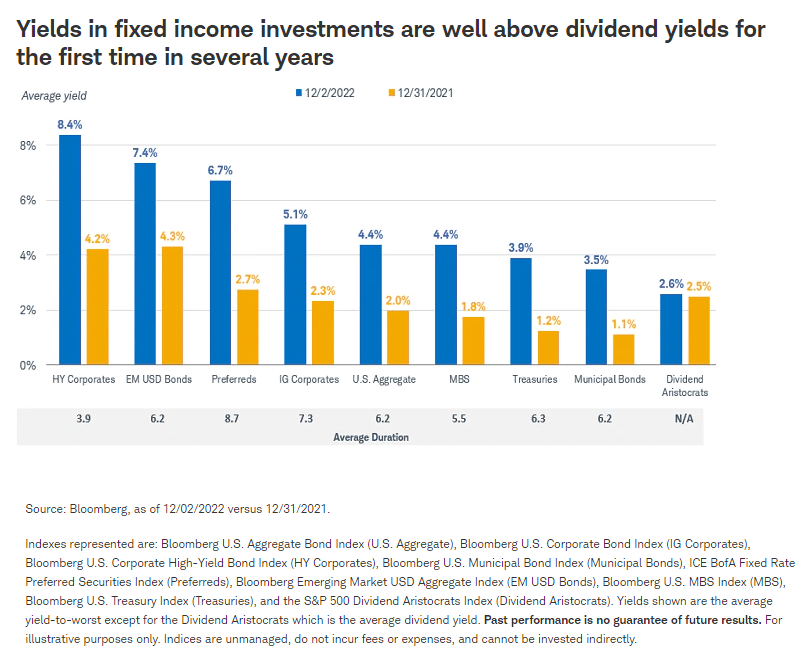

But while bonds do not look so hot in the rearview mirror, we are excited to see fixed income asset classes finally offering some yield to investors on a go-forward basis. The chart below from Charles Schwab shows the upward shift in yields over the last 12 months, while dividend yields on equities (represented here by the “Dividend Aristocrats”) have barely budged:

Source: Charles Schwab, Fixed Income Outlook: Bonds Are Back, 12/6/2022

This time last year, investors may have been tempted to take undue risk in equities simply because dividend yields were higher than the yields on offer from bonds. Fast forward to today, and investors can pick up twice the yield in investment grade corporate bonds relative to the dividend yield on the “Aristocrats”.

Bonds are not the most exciting asset class to follow, but after years of depressed interest rates, the risk/return tradeoff in fixed income is starting to improve. That, in our view, is cause for a little extra holiday cheer.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The purpose of this content is solely informational and does not constitute investment and/or tax advice. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.