Is the Bear Market Over?

The better question might be – did the bull market ever end?

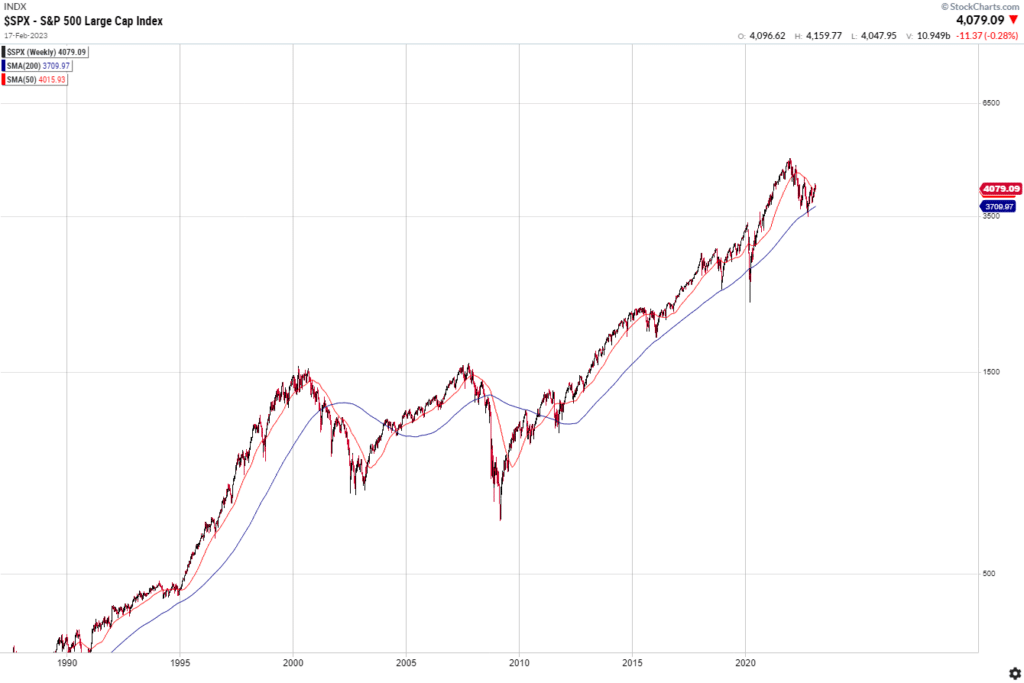

When you pull back and look at long-term averages for stock market indices like the S&P 500, the pullback in 2022 looks fairly benign. The 200-week simple moving average (SMA) is still pointing up and to the right, and the 50-week SMA never crossed below the 200-week SMA:

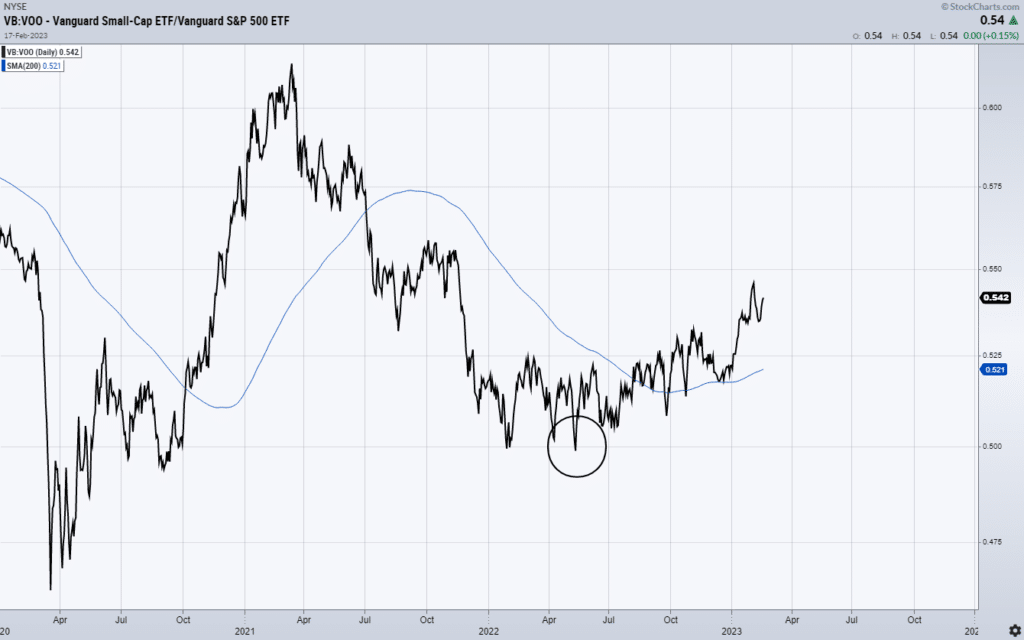

As we look at more recent trends in the market, various price action seems to contradict the view that the U.S. economy is headed for a major contraction. For instance, small-cap stocks (often more sensitive to the economic cycle than large-caps) have been outperforming the S&P 500 since the late spring of 2022:

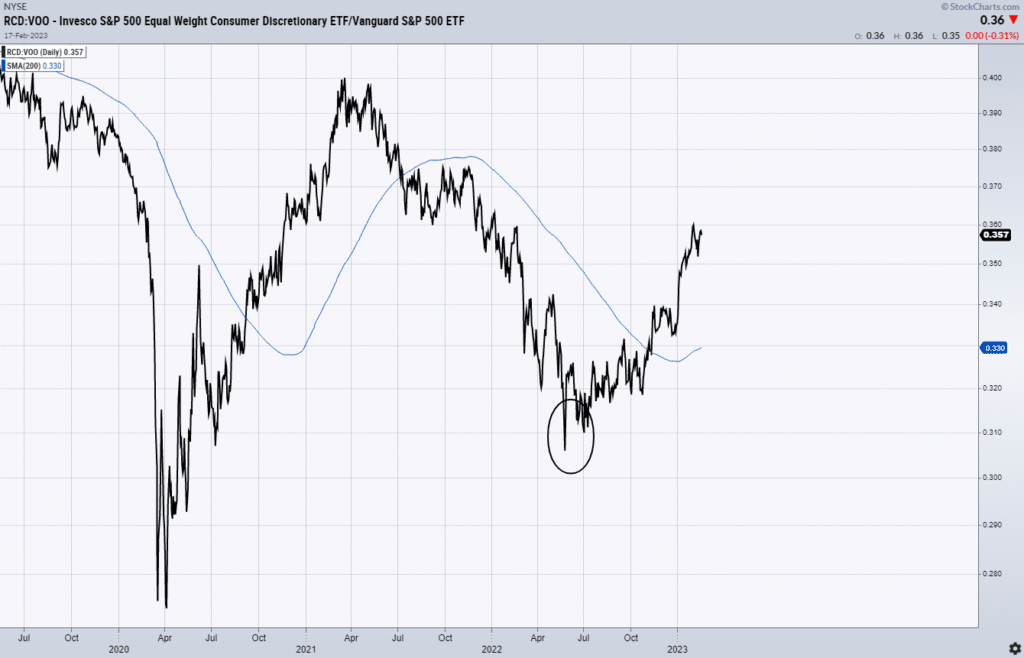

An equal-weighted basket of consumer discretionary stocks (an index that excludes the massive impact that Tesla and Amazon have on the market cap-weighted consumer discretionary index) shows that these more cyclical businesses have also been outperforming the S&P 500 since the summer of 2022:

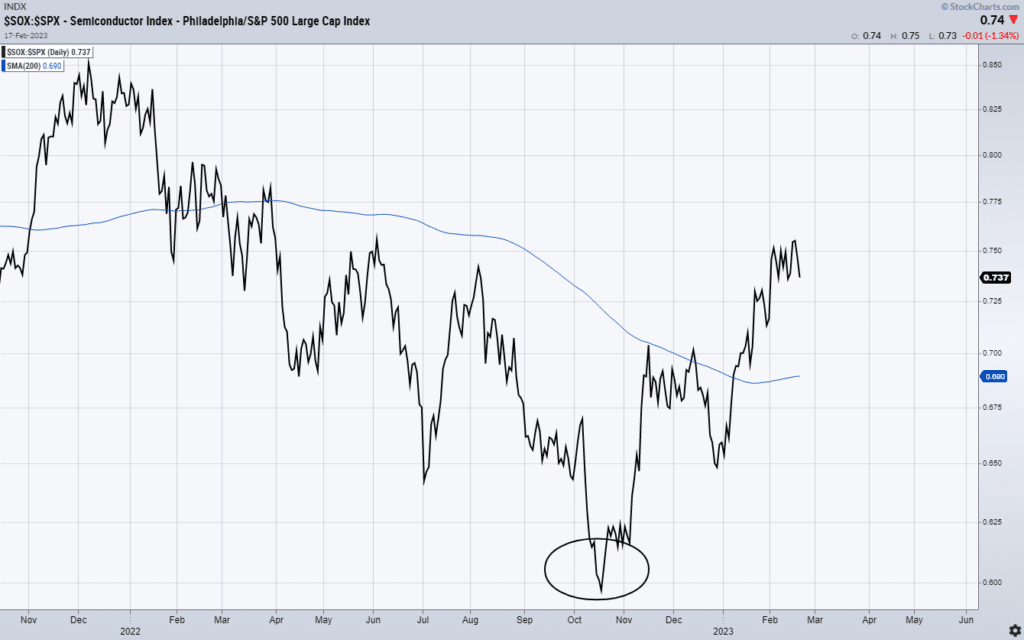

Since October, when the S&P 500 made its 52-week low, we’ve also seen semiconductor stocks outperforming the broader market. Like small-caps and consumer discretionary stocks, semiconductors often lead the market, whether to the upside or downside:

There are two adages on Wall Street about not picking fights: 1) Don’t Fight the Tape; and 2) Don’t Fight the Fed. When you look at some of the underlying strength in the stock market today, there is an argument to be made that investors should be wary of “fighting the tape”. In other words, don’t be stubborn and ignore positive price trends.

Yet the Fed continues to be the major elephant in the room. Even if you can make the case that the decade-plus bull market we’ve enjoyed since 2009 is still intact, investors are wise to be cautious about stretching for equity risk while the Fed continues on the path of interest rate hikes.

The good news is that you don’t have to pick a side and go all-in or all-out. We are encouraged by some of the recent strength in equities (don’t fight the tape!), but we can balance that optimism with a dose of skepticism (don’t fight the Fed!).

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The purpose of this content is solely informational and does not constitute investment and/or tax advice. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.