Fool Me Twice: The U.S. Housing Market

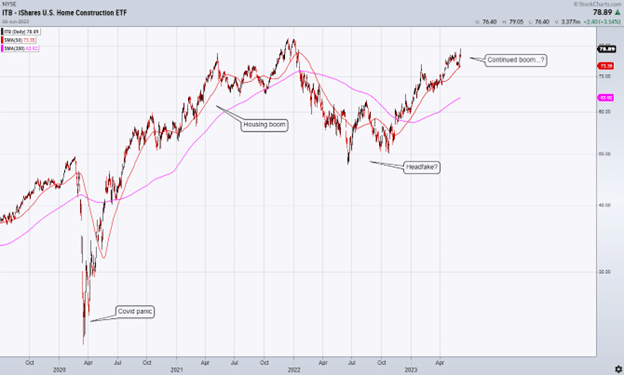

As markets internalized the risks of COVID-19 in March 2020, stock prices for home construction companies crashed (proxied here with ITB, the iShares U.S. Home Construction ETF). A precipitous drop in economic activity is historically bearish for home builders; perhaps in understandable fashion, investors rushed to sell their equity shares.

Yet just a few months later, these home builder stocks were trading at all-time highs. Through the COVID-induced housing boom, ITB would ultimately rise +244% from the March 2020 lows to its peak in December 2021.

In what appeared to be another bearish sign for home builders in 2022, mortgage interest rates more than doubled as the Federal Reserve embarked on their campaign to battle inflation. Yet once again, after a brief head fake, home builder stocks are creeping back to all-time highs.

Investors have been fooled twice by the resilience of home construction activity over the last three years. Understandably, the scars of the Global Financial Crisis and its impact on housing are deeply ingrained on the market’s collective psyche. It’s hard to imagine strength in new home construction while broader measures of economic activity weaken, but so far these companies show no sign of slowing down.

To be fair, however, it’s not just investors who have been repeatedly surprised by quirky housing market dynamics. The Federal Reserve, too, has tricked itself into a tight corner with the downstream impacts that their own policies have had on the housing market.

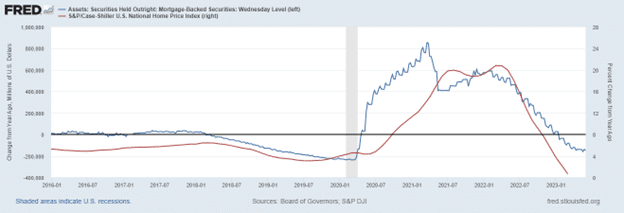

In an effort to stave off a deflationary bust in the spring of 2020, the Federal Reserve began buying assets like mortgage-backed securities (MBS), adding over $1.3 trillion dollars of MBS to their balance sheet over the course of two years. The deflationary bust was avoided, and home prices surged.

Source: FRED

The Fed continued to buy MBS even as the home buying frenzy reached a fever pitch in 2021. When mortgage rates dipped below 3%, a combination of new home buying and refinancing activity swallowed massive amounts of low-fixed-rate + long-term debt.

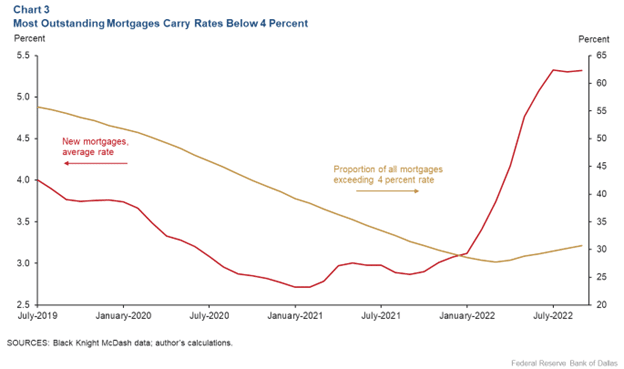

Despite the Fed’s best efforts to inflict pain on the economy with higher interest rates over the last year, home prices have held up far better than expected. Most homeowners have secured long-term mortgage debt at sub-4%, creating a “lock-in” effect that has sucked the supply of existing homes for sale out of the market. If you’re an existing homeowner with a 3.5% mortgage rate, it is an expensive prospect to move and take out a new mortgage at 6.5%.

Counterintuitively, higher interest rates may now be inflationary, as existing homeowners have little-to-no incentive to sell. While this creates a real affordability crisis for most home buyers, the marginal buyer continues to prop up prices and drive demand for new home construction.

Source: Federal Reserve Bank of Dallas

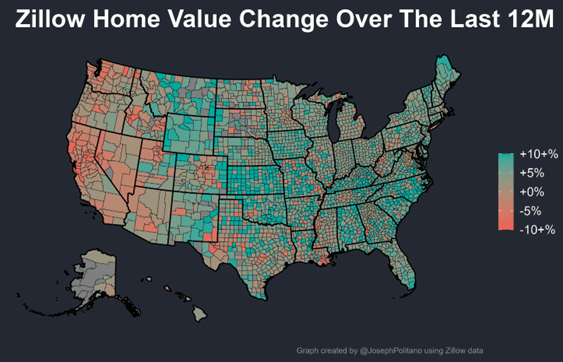

Prices have softened in pockets of the market. The map below from Joseph Politano at Apricitas Economics demonstrates how the price action has bifurcated across the country over the last year, with some regions of the country experiencing price declines while other regions continue to experience price increases.

Source: Apricitas Economics

It’s also worth noting that higher interest rates – and higher mortgage rates more specifically – may need more time to bring supply and demand for housing back into a healthier equilibrium. Irrespective of interest rate dynamics, more sellers may trickle back into the market as people are compelled to move for a job, to live closer to family, or to find more space for a growing family.

Still, both investors and policymakers at the Fed have been repeatedly fooled by the resilience of home construction activity, marginal home buyer demand, and the fact that higher interest rates can – in some cases – be supportive of elevated home prices.

The situation is a sobering reminder that no two economic cycles are alike and that the Fed may not have any playbook at all for these housing market distortions.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The purpose of this content is solely informational and does not constitute investment and/or tax advice. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.