Economic Tug of War

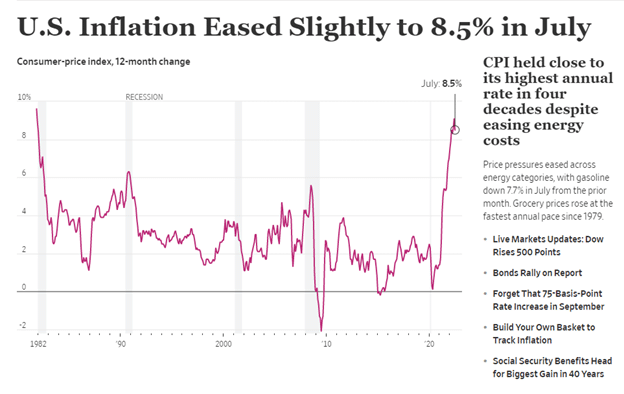

On Wednesday August 10th, the stock market rallied on news that inflation, as measured by the Consumer Price Index (CPI), may be starting to cool down. The YoY increase in CPI for July of 8.5% was down from the 9.1% print for June, a welcome change in direction and a lower reading than economists’ CPI forecasts for July.

Source: WSJ

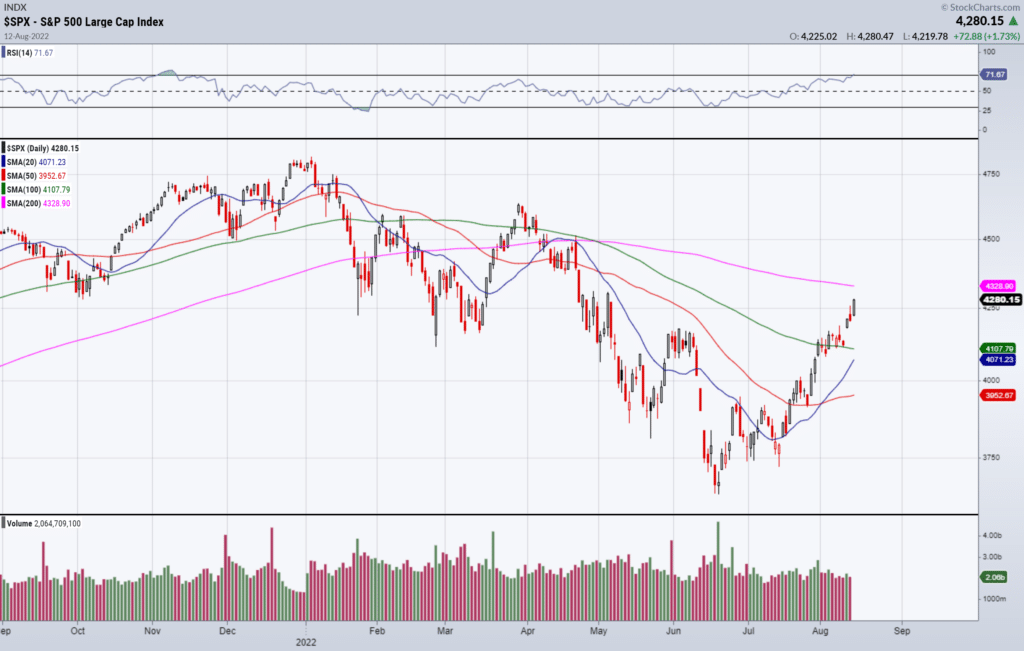

The Wednesday rally, however, was not an isolated event and the stock market may have been sniffing out a change in the pace and direction of inflation ever since the beginning of Q2. The NASDAQ has rallied +20% off its 52-week low. The S&P 500 has now closed above its 100-day simple moving average (SMA) for the last 8 sessions and has rallied past the June highs:

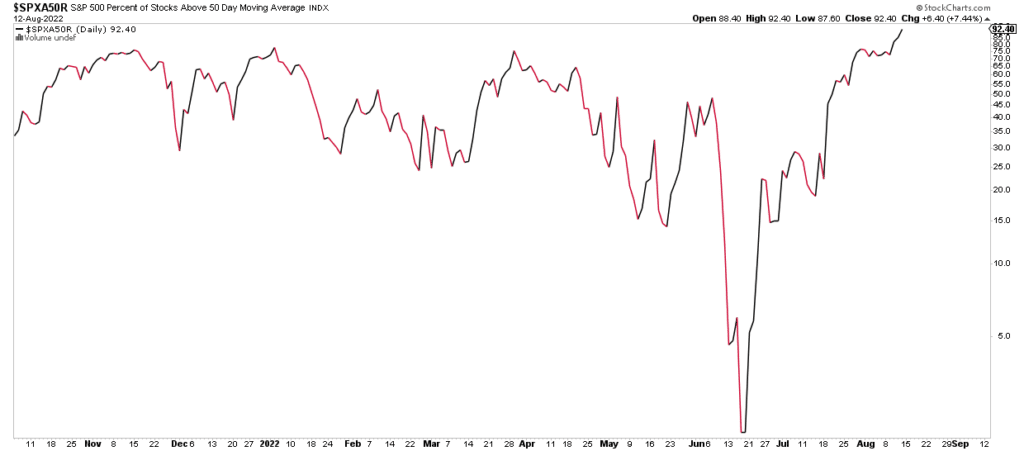

Stock market breadth has also improved, with over 90% of S&P 500 stocks now trading back above their 50-day SMA after having previously collapsed to only 2% of those stocks above their 50-day SMA in late June:

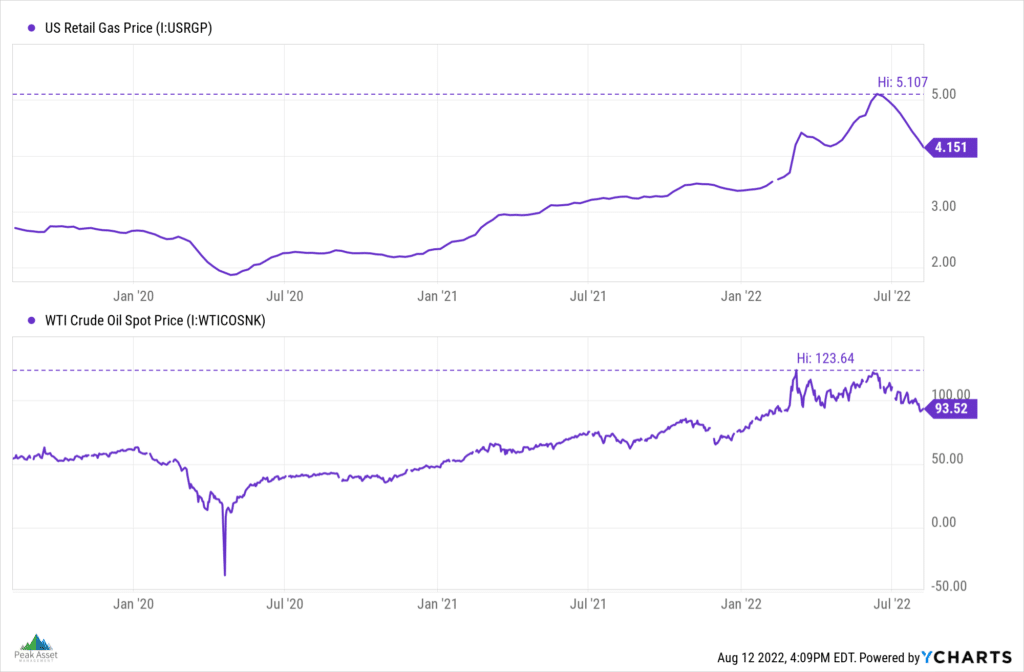

Moreover, prices in commodity markets have cooled off, with consumers seeing some relief at the gas pump in the US over the past few weeks:

The question everyone seems to be asking now is: Are we finally out of the woods with 2022’s bear market in stocks?

There is never an “all clear” signal in the stock market, so market participants will continue to debate whether or not this is just a bear market rally or the start of a new bull market; whether we’re heading into recession or not; whether the Fed will ease up on interest rate hikes or not; etc.

The short answer to these questions is that… no one knows.

I’ve heard many commentators over the last few months mention that it has “never been more difficult to forecast the direction of the economy”. My only question for them would be: When in history was it easier to forecast the future? Certainly, there have been major shifts in the geopolitical arena over the past year with the outbreak of war in Europe and cooling relations between the U.S. and China. But I would also argue that uncertainty about the future (and correspondingly how to navigate markets and investing) is the rule, not the exception.

Thus, the tug of war continues over questions like recession vs. mild slow-down, bear market rally vs. new bull market, or hawkish vs. dovish Fed interest rate policy. To make matters more confusing, “bad news” may actually be good for stocks, and “good news” may be bad for stocks.

When the Q2 GDP reading indicated a slight contraction in quarterly economic output (due to factors that would require further explanation in another post), the market seemed to welcome the news – presumably because softer growth would dovetail with a more dovish Fed. Conversely, when the jobs report indicated that the unemployment rate had dropped to 3.5%, the stock market sold off – presumably because a strong labor market goes hand in hand with more aggressive hikes to the Federal Funds rate.

The daily twists and turns in the market are challenging to navigate and the tug of war, which makes our job so fascinating, will likely never end. Only time and the benefit of hindsight will reveal how the present unfolds into the future. In the meantime, we will focus on managing risk and keeping an open mind about a wide range of potential outcomes in markets and the economy.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.