Stock Review: Booking Holdings

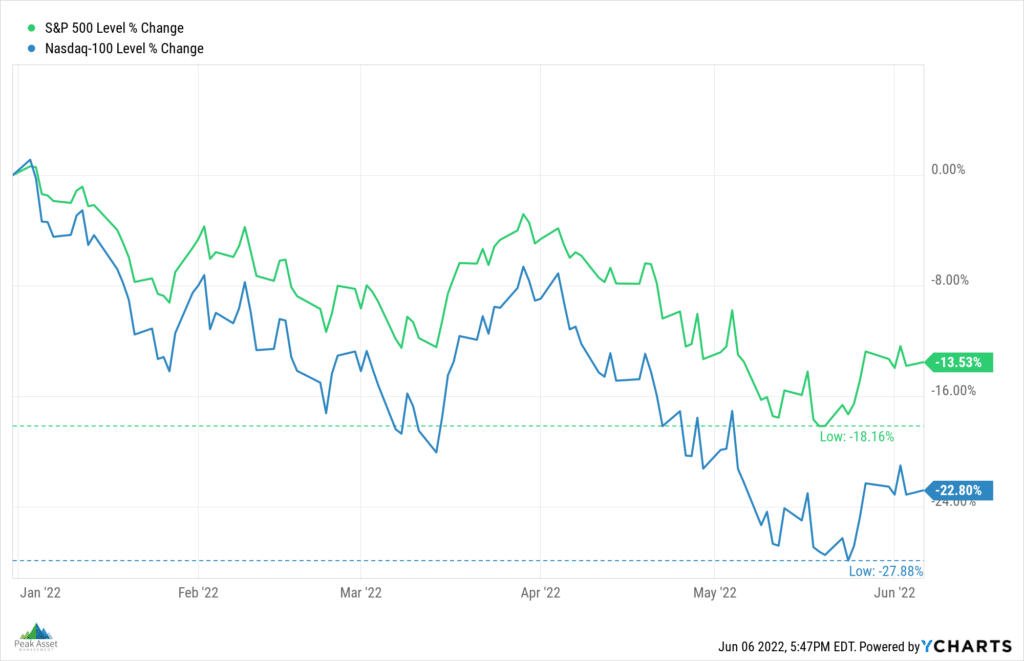

Broad stock market indices have been under pressure through the first half of 2022. As the indices slide (see the chart below), we often look to our individual stock holdings for clarity and confidence in our long-term allocations to risk assets. Directly owning businesses with strong balance sheets and healthy free cash flow margins can provide a mental boost to a long-term investment plan when markets are volatile. Against this backdrop, we thought it would be helpful to comment on the most recent addition to our model stock portfolio*, Booking Holdings (BKNG).

Booking Holdings is the largest global online travel agency by revenue. The company operates branded platforms like Booking.com, Kayak, OpenTable, Priceline, Agoda, and Rentalcars.com.

BKNG generates transaction fees by bringing together supply and demand in the marketplace for travel and other services and experiences. On the demand side, BKNG connects consumers with accommodations and airlines via their online platforms & mobile applications. On the supply side, businesses seek out BKNG as a strategic partner to fill their hotel rooms, planes, rental cars, and dining room tables. In particular, BKNG has a strong presence in international markets like Europe and with smaller, independent hotels. For instance, a boutique hotel will leverage Booking.com for their own marketing purposes and to achieve higher rates of capacity utilization.

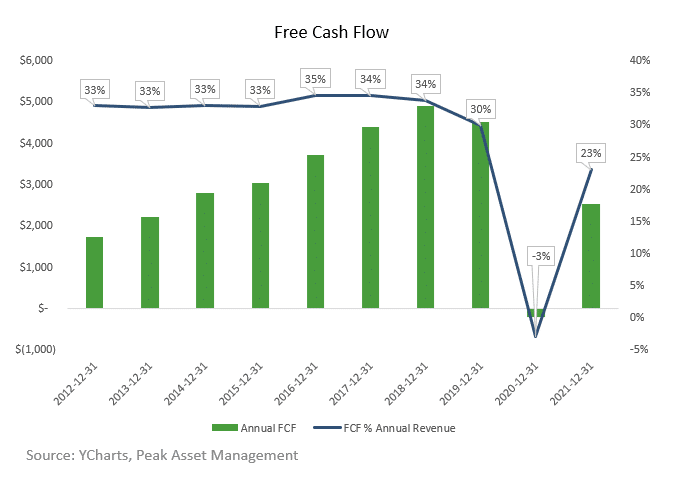

We particularly like BKNG’s operating fundamentals. They are a high-margin, asset-light technology and marketing company that deploys multiple consumer-facing brands. BKNG is a cash machine with operating margins and free cash flow margins that historically average greater than 30% of revenues (see the chart below). Thanks to their best-in class margins and dominate position in the marketplace, BKNG has a massive marketing and technology budget that they leverage to compete with other brands like Expedia. The firm’s tremendous free cash flows can also be reinvested in the growth of the business (either organically or via acquisition) or returned to shareholders via opportunistic stock buybacks.

Risks to Booking’s business include considerable competition from peers like Expedia and alternative travel platforms like Airbnb, as well as increased competition from search engine giants like Google that have built their own tools and platforms for consumers to explore and book travel experiences.

Other risk factors include Booking’s sensitivity to the economic cycle and the cyclicality of leisure travel. Not surprisingly, BKNG’s revenues and cash flows collapsed as a result of the Covid-19 pandemic; however, the business is on solid footing and is recovering lost ground as travel demand rebounds in 2022.

There is no way to perfectly time the entry into any stock, and it is no different with BKNG. To mitigate the risks of near-term volatility, we focus on appropriately sizing positions and would welcome the opportunity to continue adding to BKNG if the stock price traded lower.

Speaking of near-term volatility, the CEOs of many large corporations have publicly announced that they are now bracing for a recession. The Federal Reserve is actively working to tighten financial conditions, and newspaper headlines have lately been ripe with warnings about imminent stagflation and/or recession.

Despite these gloomy headlines, demand for travel is rapidly recovering from the pandemic. Humans are social creatures who will ultimately spend less time on Zoom and more time making dinner reservations, visiting friends and family, and adventuring around the world. Our belief is that the continued reopening of the global economy in the near-term, combined with Booking Holding’s fantastic fundamentals, make it an attractive business to own for the long-term.

*The Model Portfolio is not a real cash portfolio. It represents the core direction of our portfolio management strategies. Individual client portfolios are managed in accordance with the clients’ specific investment objectives and constraints. Historical results are available upon request.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.