Discounted Cash Woes

It’s earnings season on Wall Street, an opportunity for investors to peer into the latest financial results of publicly traded companies.

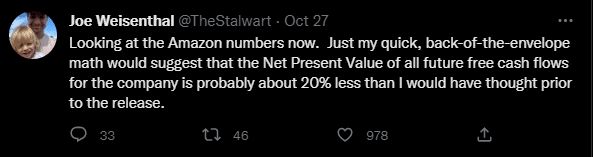

When Amazon reported earnings on October 27th, the stock dropped about 20% the following day. Joe Weisenthal at Bloomberg quipped that after looking at their numbers, “back-of-the-envelope math would suggest that the Net Present Value of all future free cash flows for the company is about 20% less than I would have thought prior to the release”.

The merit of following quarterly earnings reports is much debated in the investment community. On the one hand, putting companies under the microscope each quarter results in an unhealthy game of analysts (and investors, traders, pundits, etc.) putting too much weight on the numbers, which leads the companies themselves to manage to the quarterly numbers. The assumption is that this distracts from long-term value creation and sound capital allocation decisions that (purportedly) the management team would otherwise be making.

On the other hand, the benefits of routine financial reporting in the public markets are numerous. At the most basic level, it is interesting to glean insights about the world and the economy from some of the brightest minds in the business community (imbued, of course, with all the biases that are tied to their position in a publicly traded company). But also, quarterly reports help provide the transparency and accountability that are necessary for the healthy functioning of capital markets and the economy.

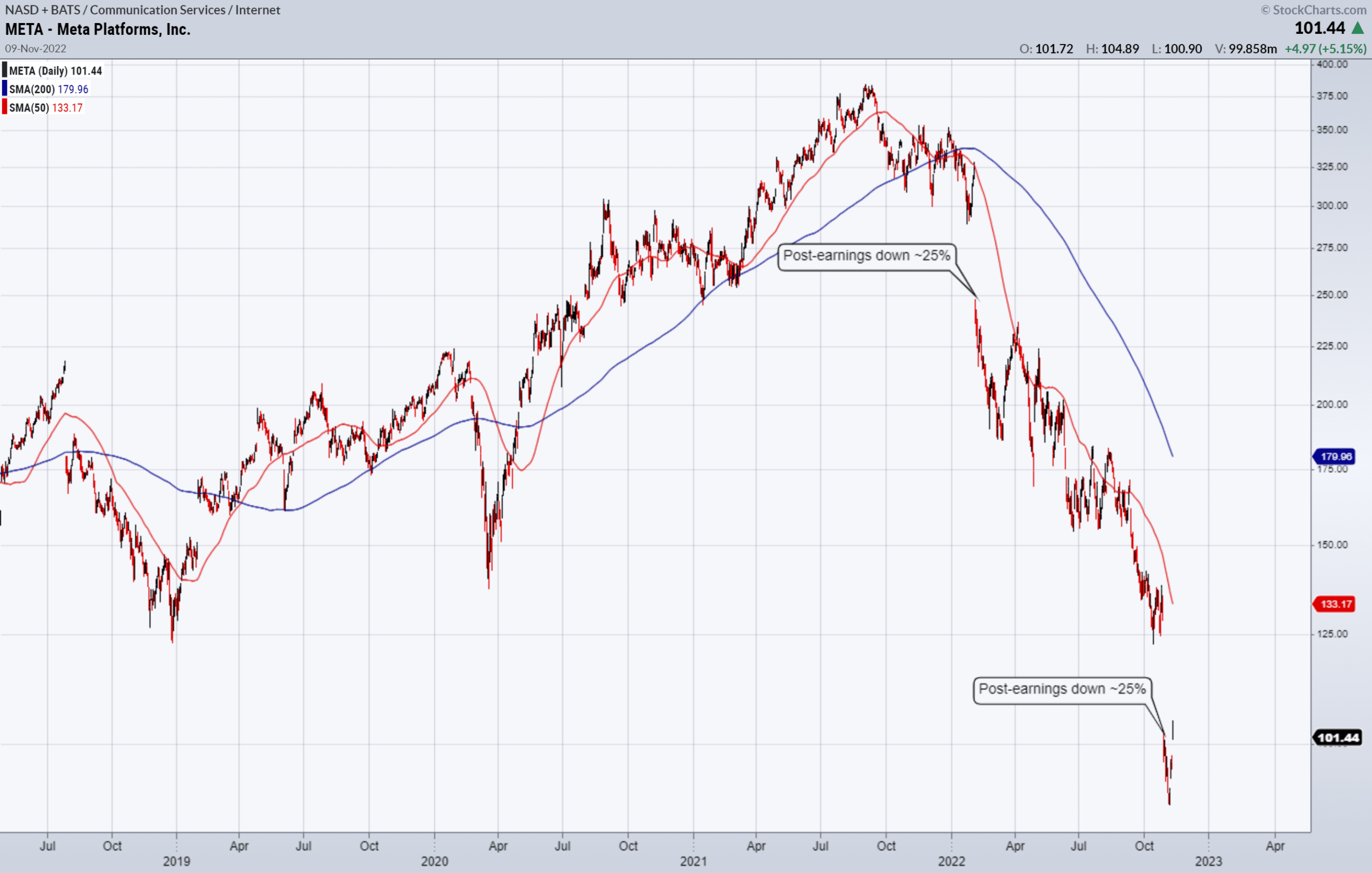

The results from one quarter typically have little meaning in relation to the long-term success (or lack thereof) for a firm. Yet, we often see large price swings in the stock on the heels of a company’s earnings announcement. A notable example this year includes Meta (formerly known as Facebook):

To be sure, there are major developments quarter-to-quarter that can change the long-term fundamentals and trajectory of a firm. Meta has clearly stated that they are going to direct billions of dollars of investment into the so-called “metaverse”, and they are spending heavily on data centers and artificial intelligence to get there. An epic debate is playing out in real time as to whether or not these investments will pay-off and result in the kind of growth and cash flows that investors demand.

Over the past year, META stock is down 73%. Whether or not that means the net present value of all future cash flows has dropped by that amount over that time frame depends on who you ask, and it depends on the “back of the envelope math” they use to arrive at their conclusion.

On balance, earnings season can be both a curse and a blessing. Wild swings and volatility in the stock market can distract investors from their long-term goals, and we know that the most reliable path to building wealth takes time and patience. On the other hand, it’s incredibly important (and fun!) to get a look under the hood in the public markets. As a long-term investor, the key to navigating the inevitable ups and downs is to know what you own and why you own it, and then let time work its magic.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The purpose of the blog is solely informational and does not constitute investment and/or tax advice. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.