The recent debacle at FTX and the broader selloff in cryptocurrencies over the past year have us thinking a lot about our investment discipline and why we believe in owning productive assets.

What makes for a good investment strategy? In our view, the simple answer is to buy productive assets. No doubt there are a number of different ways to invest in productive assets – and not all productive assets are created equal – but generally speaking, investors can sidestep a lot of pain and trouble by avoiding non-productive assets.

For a primer on what makes for a productive asset, let’s borrow from Warren Buffett’s 2011 letter to Berkshire Hathaway’s shareholders:

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A.

Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?

A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. Exxon Mobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

In the example above, you could replace gold with Bitcoin and the same basic framework applies. Bitcoin is non-productive and produces no free cash flow. An investor with a disciplined strategy of buying productive assets can avoid the emotional rollercoaster of trying to decide when, how, and why they might buy Bitcoin (or any other cryptocurrency for that matter) and at what price.

For the most part, it seems that the thesis for owning Bitcoin is that eventually someone will be willing to pay you more than your purchase price to take it off your hands.

It is extremely hard to stay focused as a long-term investor. Deploying strong filters and “rules of thumb” to simplify the universe of investment opportunities allows for the prudent, long-term investor to preserve their mental and emotional energy and time for the things that truly matter.

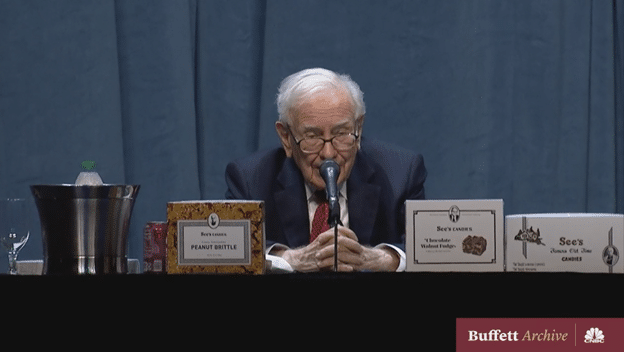

*Speaking of Warren Buffett, here’s a fun clip on why he wouldn’t buy all of the Bitcoin in the world for $25:

For additional thoughts on cryptocurrencies, check out our blog Money, Credit, and Crypto from September 2021.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The purpose of the blog is solely informational and does not constitute investment and/or tax advice. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.