“Recent indicators point to modest growth in spending and production. Job gains have picked up in recent months and are running at a robust pace; the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.”

Excerpt from Federal Reserve FOMC statement

March 22, 2023

A Good Place to Start

For investors, 2023 started with a huge advantage over the last one and a half decades. In December 2022, the overnight federal funds rate was raised to 4.25% – 4.50% (up from 0% – 0.25% one year earlier). That marked the first time that the benchmark for short-term interest rates was over 4% since the beginning of 2008. Walking in the door on January 1st, we knew that all of our clients would be starting the new year with some real income coming into their accounts from their most conservative investments. That income, in turn, would help cushion any downside market volatility from stocks and longer-dated bonds. Investing in money markets and short-term bonds provides, once again, more than just low-risk diversification and liquidity. Money markets and short-term bonds are, once again, real cash flow generators.

The Broad Market Indexes are Higher

The S&P 500 stock market index had a strong start in 2023. After losing (-18.11%) in 2022, it finished with a total return of +7.5% in the 1st Quarter. Beneath the surface, the component returns of the S&P 500 were quite variable, both higher and lower. For example, the “equal weight” S&P 500 that ignores the market capitalization size of the individual stocks was up +2.89%. And, digging a little deeper, in a reversal of fortunes from 2022, Information Technology was the best performing Sector with a +20.93% gain, while Utilities (-3.04%), Health Care (-3.55%), Energy (-4.93%) and Financials (-5.30%) all finished in negative territory. Not surprisingly, after two bank failures in March, the S&P Bank ETF was down (-17.29%). Effectively, in the first quarter big cap technology stocks drove the S&P 500’s return. Likewise, the iShares US Aggregate Bond ETF had a strong start with a +3.23% gain in the first quarter, after losing (-13.03%) in 2022. That return reflects the fact that longer-term rates dropped during the quarter even as the Federal Reserve (the Fed) was still hiking its overnight fed funds on March 22nd (the fed funds rate was raised to 4.75%-5%). The 2-year Treasury note, the 5-year Treasury note and the 10-year Treasury note all ended the quarter with lower yields than where they began the year. Since investors can get a higher yield in shorter-term bonds, the fact that they are buying longer dated bonds implies they believe the Fed will pivot direction and start lowering interest rates in the not-too-distant future.

The Fed and Anniversaries

Last month marked both the 3-year anniversary of the initial response of the Fed to the pandemic-induced financial market crash in 2020 as well as the 1-year anniversary of the Fed’s first interest rate hike in its current battle with inflation. I think it is fair to say the two are linked; that is, the current struggle with inflation was created in part because of the forceful response of the Fed in its direct intervention in the financial markets and its aggressive loosening of monetary policy. When combined with the U.S. government’s historic fiscal injections and the direct impacts of the pandemic on people and the economy (loss, disruption and change), the overall result was that the supply and demand forces in goods, services and labor (and the financial markets) were pushed and pulled in different directions. For the last year, the Fed has actively been trying to slow the economy to bring supply and demand back in balance.

The Economy has Slowed

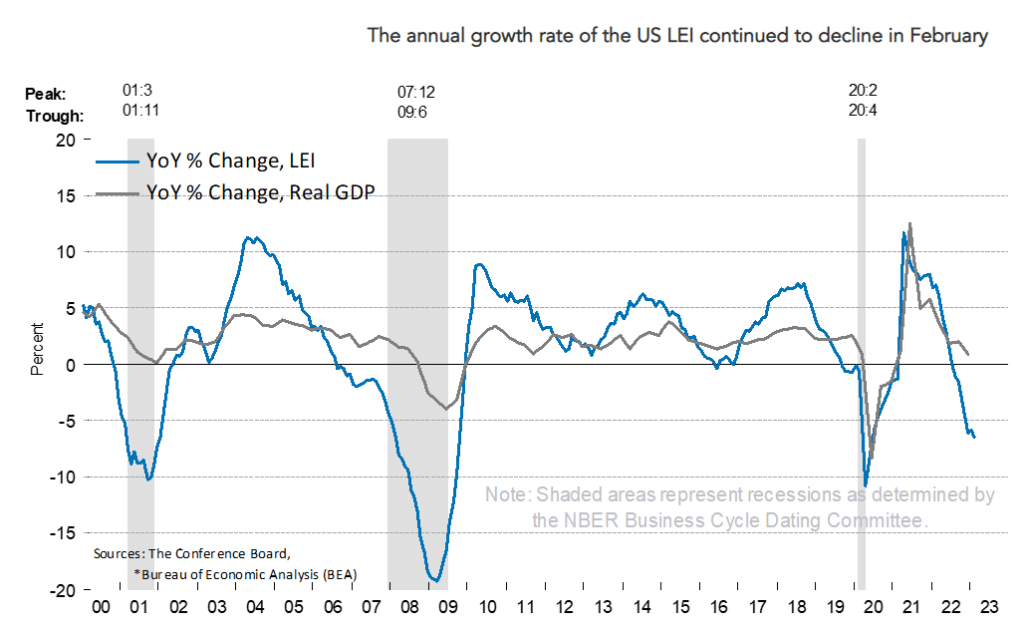

As the Fed noted in its excerpt that opened this letter, there is still strength in the economy and the labor market. The Atlanta Fed currently estimates that the economy grew at a 2.2% real annualized rate in the 1st quarter and the March unemployment rate was just off a 50 year low at 3.5%. There is also plenty of evidence that the economy is slowing and that inflation is coming down. On the economy, the chart above shows a historical look at the Conference Board’s US. Leading Economic Indicators (LEI). The blue line represents the LEI and the grey line represents Real U.S. Gross Domestic Product (GDP). The shaded grey areas represent recessions. You can see that the LEI has already reached levels that have coincided with past recessions. On the inflation front, the Consumer Price Index (CPI) for March came in at 5%. That marks a nice reduction from its 9.1% peak last summer, but it is still well above the Fed’s stated 2% inflation target. The Fed has reiterated many times that it will keep interest rates higher for longer to meet its target, but it is easier to say that when the economy is not in a recession and harder to stick with it once a recession has begun. To its credit, in matching its deeds with its words, the Fed did follow through on hiking the fed funds rate just a little over a week after the Silicon Valley Bank and Signature Bank failures. The cracks are starting to show and I am sure the Fed is hoping that inflation will come down enough before its conviction is tested even further.

Economic cycles happen in years. For long term investors and portfolio managers patience is an essential skill. Peak focuses on matching investments with clients’ cash flow needs. We focus on the details of the individual investments in a client’s portfolio and how they work together as a whole. And we prepare for withstanding the back end of a cycle with an eye toward being in a position to take advantage of the attractive opportunities as they unfold. It has been a long time since we have gone through a full economic cycle (at least to me, the pandemic was a very different kind of event – the quick and forceful response by the Fed and the government basically prevented the completion of the credit correction side of the cycle). As the world unfolds at its own pace, higher cash flow remains a good place to start.

We hope this letter finds you and your family well. We appreciate your business and we continue to work hard to earn the trust that you have placed in us. Please let us know if you have a friend or a family member who could use our assistance.

John McCorvie, CFA

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The purpose of this content is solely informational and does not constitute investment and/or tax advice. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.