Stock Review: VF Corporation

We’ve written in the past about our mindset of buying businesses as a way to ground and guide our investment philosophy. In that spirit, we’ve recently added a new business – VF Corporation (VFC) – to our model portfolio.

VF Corp is an apparel company that owns outdoor and lifestyle brands like The North Face, Vans, Timberland, and Smartwool. At the end of their fiscal 3rd quarter (December 31, 2022), trailing twelve-month revenues were $11.7 billion and the stock currently has a market cap of about $8.5 billion.

VFC had a challenging year in 2022 and the stock is in a 78% drawdown from its all-time high. Supply chain issues, transit delays, cost inflation, and a shift in consumer spending resulted in a massive build-up of inventory on their balance sheet. Lead times for manufacturing and shipping were thrown out of balance during the pandemic, making it difficult for apparel manufacturers to efficiently match supply with customer demand.

Supply chain issues worked against VFC in both directions: Production capacity was constrained in 2021 and it was challenging to meet customer demand. In 2022, supply chain issues eased just as retailers and other VFC customers started to cancel or reduce their product orders.

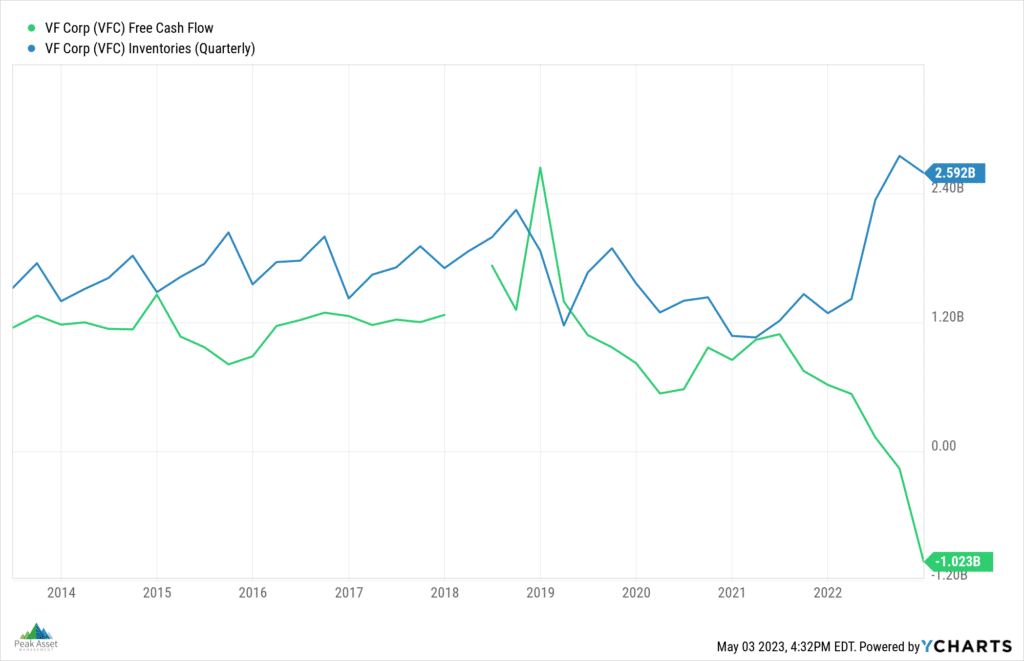

You can see in the chart below how inventories jumped in 2022 and, correspondingly, VFC’s free cash flow dropped precipitously:

We like looking at a business when its stock price has been beaten up and when they are facing known challenges. Particularly when a cyclical business takes a hit on revenues and margins, headwinds can eventually flip to tailwinds. For instance, the negative impact that inventory has on free cash flow as it builds on the balance sheet can catalyze a rebound in cash flow as those inventories are eventually sold off.

We became particularly interested in VF Corporation when the management team cut the dividend by 41% (from $0.51 to $0.30 quarterly) in February of this year. Given the pressures on VFC’s balance sheet as a result of supply-chain issues, it was prudent for the company to cut the dividend and preserve cash.

The company is now prioritizing investment in marketing and innovation at brands like Vans to reinvigorate growth and profitability. Moreover, preserving cash and shoring up the balance sheet will allow VFC to continue their strategy of strategic mergers and acquisitions to strengthen their broader portfolio of active lifestyle brands.

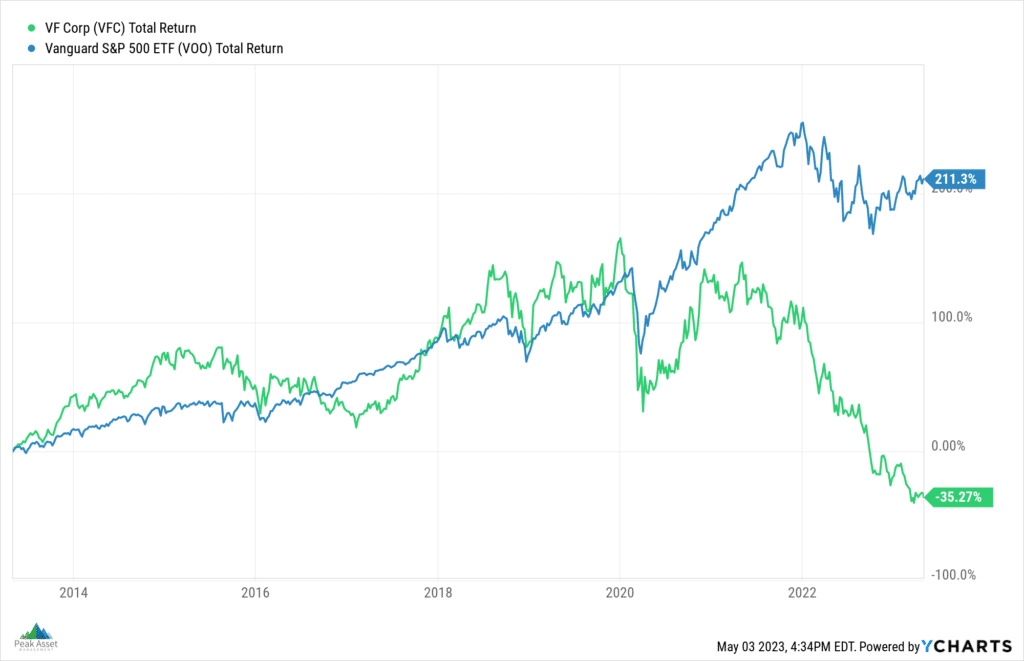

While there are near-term challenges for the company to sort through, we believe this is a unique opportunity to buy a business with a margin of safety to its fair value in an environment where broader market indices are fully valued. The chart below compares the total return in VFC to the S&P500 over the last ten years:

The future is never certain, and the stock may continue to fall from here, but we believe VF Corp is in a position to return to stronger growth and profitability and that the risk vs. return tradeoff is attractively priced at these levels.

Peak Asset Management, LLC is an SEC-registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The purpose of this content is solely informational and does not constitute investment and/or tax advice. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.