The Backstory

Paccar, a global manufacturer of medium and heavy-duty trucks with annual sales of around $20 billion, is one of the stocks in our Model Portfolio*. We were intrigued to see Paccar’s stock (PCAR) up +10% on January 21, 2021. With a standard deviation of daily returns of 1.6% over the past 10 years, PCAR is not prone to such a large daily swing.

There was no surprise earnings announcement or other major news surrounding PCAR on January 21st. Two days earlier on January 19th, however, PCAR did announce a partnership with Aurora, an autonomous vehicle company backed by Amazon and Sequoia Capital. What is interesting about this timeline is that following the partnership announcement, the asset management firm ARK Invest added Paccar to its flagship ETF product, the ARK Innovation ETF (ARKK), on January 20th.

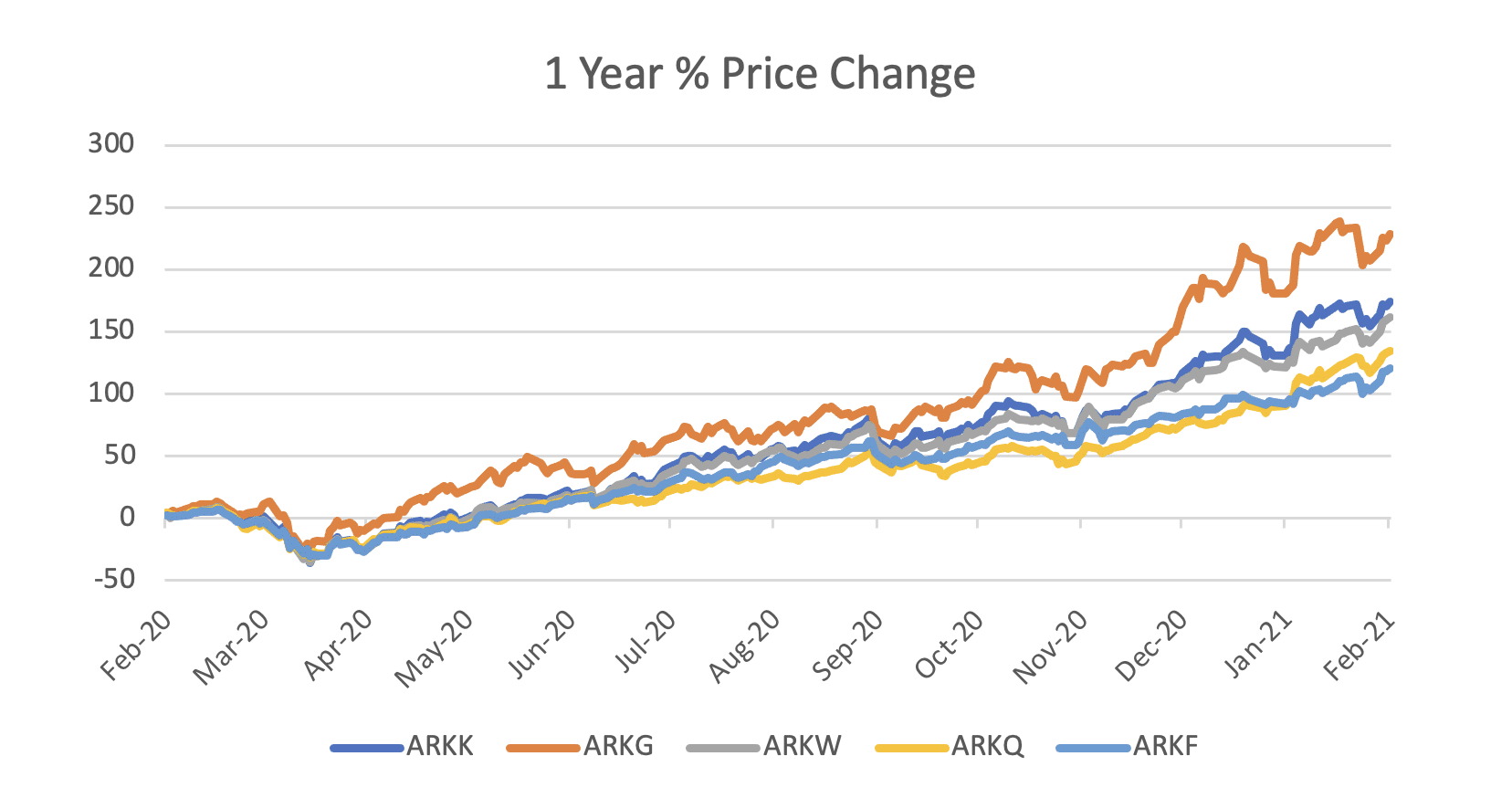

ARK is a relatively new ETF provider that invests exclusively in themes around “disruptive innovation”. Until 2020, assets under management (AUM) across all of ARK’s products were fairly modest. Over the past year, however, their funds have delivered eye-popping returns and assets under management have exploded. On March 31, 2020, the ARK Innovation ETF (ARKK) had $2 billion under management. Today, that number has increased 12x to over $24 billion AUM.

To explore the underlying businesses tied to ARK ETFs and their recent price performance would require its own post. For the purpose of this missive, we wanted to explore the connection between the price action in Paccar on January 21st and the news that it was added to the ARK Innovation ETF on January 20th.

Thematic Investing

Active ETF providers like ARK differ from passive ETFs that track an index by making buy/sell/hold decisions in their funds. In ARK’s case, their team of analysts and portfolio managers are continually picking stocks to add or remove from their products. Because these decisions need to be disclosed to the public, other investors are able to jump on the bandwagon and replicate the strategies being used by an active manager.

This is not a new phenomenon. Investors have always had opportunities to (more or less) copy the strategies of other investors they might admire. However, the narrative surrounding ARK Invest and the success they have enjoyed over the past year has taken on a life of its own through a process known as reflexivity.

Reflexivity in finance and economics is a concept championed by famed investor George Soros. The idea is that investors’ perceptions about reality impact reality itself through feedback loops, ie. self-fulfilling prophecies. Reflexivity is a derivative of momentum, whereby success begets success. A stock that is rising in price is perceived to be a success. People want to participate in that success, and thus buy the stock and continue to drive up the price. The virtuous cycle continues, and what may have started as a perception about the business’s potential for success may give rise to that very outcome in reality (at least for a time). With an elevated stock price, the business can raise capital to invest in itself and build a competitive moat.

In the midst of the global pandemic, technology companies have thrived while many other businesses have stalled or gone bankrupt. Combined with massive injections of liquidity into financial markets, a tremendous rally in technology stocks has captivated the public’s attention over the past year. As technology-oriented ETF strategies like ARK outperform the broader market in dramatic fashion, a cult-like devotion has developed around their strategies. In turn, investors are pouring capital into businesses that have been anointed by the team at ARK.

While we cannot say it was the only driver, we think it is fair to draw a connection between PCAR stock up +10% in one day and news that the ARK Innovation ETF added it to their portfolio. With the ubiquity of social media, a new breed of financial voyeurism has crept into the markets, feeding a reflexive process of momentum behind “disruptive innovation” strategies. Tesla is the poster child of this process, with bullish narratives for the stock spread across Twitter, Tik-Tok, Reddit, and new socially driven brokerage platforms like Public (investors can replicate strategies that have been made publicly available by other investors on the platform). On the day we saw Paccar jump by +10%, these platforms were abuzz with the news that the ARK Innovation ETF had added PCAR to their holdings the previous day.

These narratives and trends are fascinating to watch unfold in real time. Whether or not the recent price performance in ARK ETFs is sustainable is anyone’s guess; over time, the market value of stocks is based on real cash flows, not hypothetical scenarios that may or may not play out in the future. Irrespective of what ARK Invest is doing, we believe Paccar will continue to generate strong cash flows, innovate, and build great products that grease the wheels for global commerce.

*The Model Portfolio is not a real cash portfolio. It represents the core direction of our portfolio management strategies. Individual client portfolios are managed in accordance with the clients’ specific investment objectives and constraints. Historical results are available upon request.

Peak Asset Management, LLC is an SEC registered investment adviser. This is not an offer to buy or sell securities. Past performance is not indicative of current or future performance and is not a guarantee. The information set forth herein was obtained from sources which we believe to be reliable, but we do not guarantee its accuracy.

share article

Get our latest insights

Subscribe to our quarterly newsletter for all the latest news and information about investing and financial planning.